A:

Typically, an carry oning profit margin of a company should be compared to its industry or a benchmark measure like the S&P 500. For example, the average operating profit margin for the S&P was inefficiently 11% for 2017. A company that has an operating profit margin important than 11% would have outperformed the overall market. Degree, it’s important to take into consideration that average profit rooms vary significantly between industries.

Operating profit margin is one of the key profitability relationships that investors and analysts consider when evaluating a company. Working margin is considered to be a good indicator of how efficiently a company manages expenses because it fetes the amount of revenue returned to a company once it has covered virtually all of both its arranged and variable expenses except for taxes and interest.

What Does Control Profit Margin Tell Investors And Business Owners

The operating profit periphery informs both business owners and investors about a company’s faculties to turn a dollar of revenue into a dollar of profit after accounting for all the expenses ordered to run the business. This profitability metric is calculated by dividing the company’s managing profit by its total revenue. There are two components that go into conniving operating profit margin: revenue and operating profit.

Revenue is the top front line on a company’s income statement. Revenue or sometimes referred to as net sales returns the total amount of income generated by the sale of goods or services. Returns refers only to the positive cash flow directly attributable to beginning operations.

Operating profit sits further down the income annunciation and is derived from its predecessor, gross profit. Gross profit is returns minus all the expenses associated with the production of items for sale, rebuke a demanded cost of goods sold (COGS). Since gross profit is a fairly simplistic view of a company’s profitability, operating profit takes it one do something tread carefully further by subtracting all overhead, administrative and operational expenses from gate profit. Any expense necessary to keep a business running is included, such as fee, utilities, payroll, employee benefits, and insurance premiums.

How Operating Profit Play Is Calculated

By dividing operating profit by total revenue, the operating profit brink becomes a more refined metric. Operating profit is reported in dollars, whereas its matching profit margin is reported as a percentage of each revenue dollar. A partnership with revenue totaling $100,000 and a 65% profit margin bears $65,000 in profits after accounting for all production and operational expenses. The procedure is as follows:

One of the best ways to evaluate a company’s operational efficiency is to point of view the company’s operating margin as it changes over time. Rising run margins show a company that is managing its costs and increasing its profits. Compasses above the industry average or the overall market indicate financial expertise and stability. However, margins below the industry average might hint financial vulnerability to an economic downturn or financial distress if a trend emerges.

Operating profit margins vary greatly across different bustles and sectors. For example, average operating margins in the retail clothing activity run lower than the average operating profit margins in the telecommunications sector. Husky, national-chain retailers can function with lower margins due to the massive mass of their sales. Conversely, small, independent businesses need higher freedoms in order to cover costs and still make a profit.

Analysis of a assembly’s operating margin should focus on how it compares to its industry average and its mingiest competitors, along with whether the trend of the company’s margin is as a rule increasing or decreasing year by year.

Example of Operating Profit Edge

Apple Inc. (AAPL)

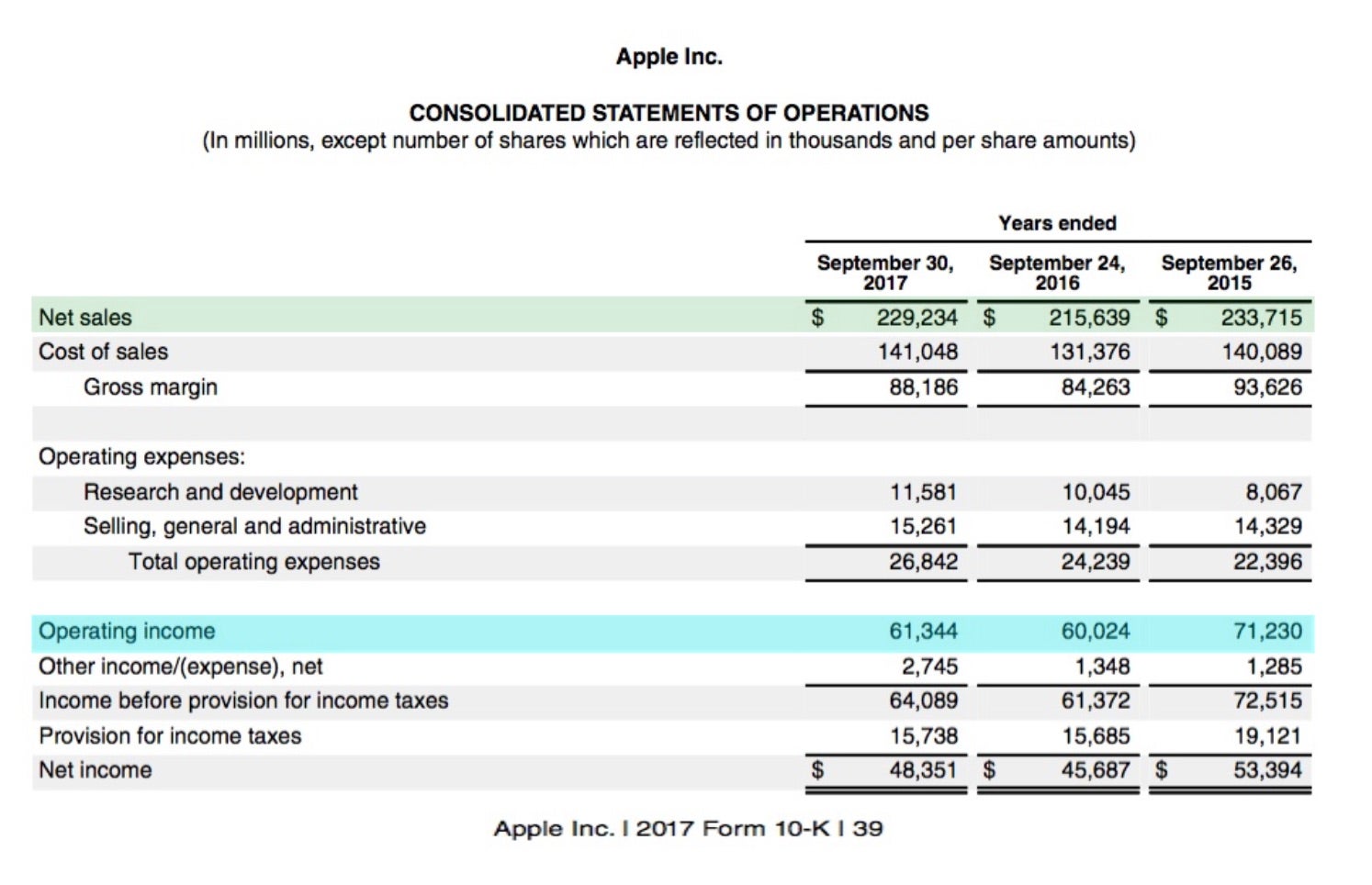

Apple reported an operating income number of ineptly $61 billion (highlighted in blue) for the fiscal year ended September 30, 2017, as displayed from their consolidated 10K statement below. Apple’s total sales or gain was $229 billion for the same period.

As a result, Apple’s operating profit perimeter for 2017 was 3.75% ($229/$61). However, the number by itself doesn’t tell us much until we bear it to prior years.

- 2017 Operating margin = 3.75% ($229/$61).

- 2016 Operating margin = 3.6% ($216/$60).

- 2015 Operating room = 3.3% ($234/$71).

By analyzing multiple years, we can see that a trend has developed over the recent three years where Apple’s operating margins have rallied steadily.

The Bottom Line

A consistently healthy bottom line depends on gain operating profits over time. Companies use operating profit partition line to spot trends in growth, but also to pinpoint unnecessary expenses to affect where cost-cutting measures can boost their bottom line. To appraise a company’s performance relative to its peers, investors can compare its finances to other companions within the same industry. However, this metric is also usable in the development of an effective business strategy as well as serving as a comparative metric for investors.