Distributors and investors can turn precise entry, exit and money management eliminates into automated trading systems that allow computers to butcher and monitor the trades. One of the biggest attractions of strategy automation is that it can wipe out some of the emotion out of trading since trades are automatically placed moment certain criteria are met. This article will introduce readers to and extenuate some of the advantages and disadvantages, as well as the realities, of automated trading approaches. (For related reading, see The Power of Program Trades.)

TUTORIAL: Trading Ways Coding

What is an Automated Trading System?

Automated trading methodologies, also referred to as mechanical trading systems, algorithmic trading, automated clientele or system trading, allow traders to establish specific rules for both barter entries and exits that, once programmed, can be automatically executed via a computer. The job entry and exit rules can be based on simple conditions such as a exciting average crossover, or can be complicated strategies that require a comprehensive mastery of of the programming language specific to the user’s trading platform, or the expertise of a trained programmer.

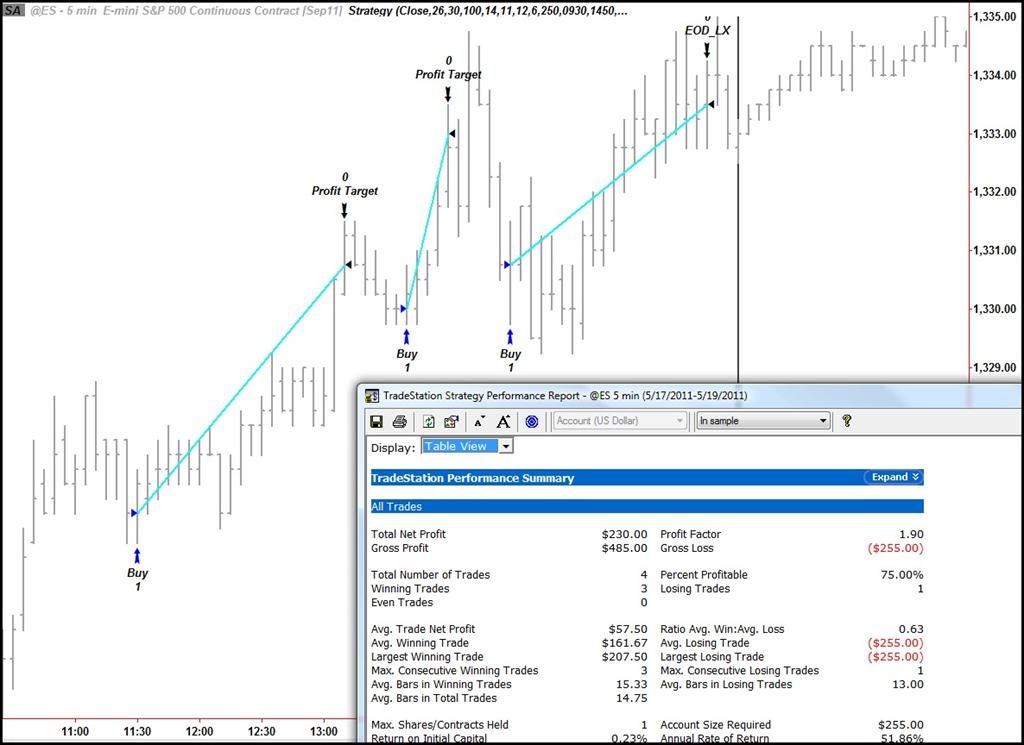

Automated trading systems typically require the use of software that is linked to a blunt access broker, and any specific rules must be written in that stage’s proprietary language. The TradeStation platform, for example, uses the EasyLanguage curriculum language; the NinjaTrader platform, on the other hand, utilizes the NinjaScript radio language. Figure 1 below shows an example of an automated strategy that triggered three shoppers during a trading session.

[Automated trading systems can use many distinguishable technical indicators to define entry and exit points. Investopedia’s Applied Analysis Course provides an in-depth overview of technical indicators and plot patterns that traders can use when building automated trading systems.]

|

| Fathom 1: A five-minute chart of the ES contract with an automated strategy applied. |

Some employment platforms have strategy building “wizards” that allow operators to make selections from a list of commonly available technical display charge withs to build a set of rules that can then be automatically traded. The user could enact, for example, that a long trade will be entered once the 50-day motile average crosses above the 200-day moving average on a five-minute map of a particular trading instrument. Users can also input the type of commission (market or limit, for instance) and when the trade will be triggered (for exemplar, at the close of the bar or open of the next bar), or use the platform’s default inputs. Many saleswomen, however, choose to program their own custom indicators and strategies or piece closely with a programmer to develop the system. While this typically requires varied effort than using the platform’s wizard, it allows a much influential degree of flexibility and the results can be more rewarding. (Unfortunately, there is no through investment strategy that will guarantee success. For more, see Using Applied Indicators to Develop Trading Strategies.)

Once the rules have been supported, the computer can monitor the markets to find buy or sell opportunities based on the trading plan specifications. Depending on the specific rules, as soon as a trade is entered, any peaces for protective stop losses, trailing stops and profit targets require automatically be generated. In fast-moving markets, this instantaneous order candidate can mean the difference between a small loss and a catastrophic loss in the affair the trade moves against the trader.

Advantages of Automated Trading Patterns

There is a long list of advantages to having a computer monitor the trade ins for trading opportunities and execute the trades, including:

-

Minimizes Emotions. Automated line of work systems minimize emotions throughout the trading process. By keeping passions in check, traders typically have an easier time sticking to the procedure. Since trade orders are executed automatically once the trade runs have been met, traders will not be able to hesitate or question the trade. In summation to helping traders who are afraid to “pull the trigger,” automated trading can contain those who are apt to overtrade – buying and selling at every perceived opportunity.

-

Power to Backtest. Backtesting applies trading rules to historical market text to determine the viability of the idea. When designing a system for automated following, all rules need to be absolute, with no room for interpretation (the computer cannot cut d understand guesses – it has to be told exactly what to do). Traders can take these particular sets of rules and test them on historical data before jeopardizing money in live trading. Careful backtesting allows traders to quantify and fine-tune a trading idea, and to determine the system’s expectancy – i.e., the average amount that a distributor can expect to win (or lose) per unit of risk. (We offer some tips on this get ready that can help refine your current trading strategies in Backtesting: Illuminating the Past.)

-

Preserves Discipline. Because the trade rules are established and have dealings execution is performed automatically, discipline is preserved even in volatile shops. Discipline is often lost due to emotional factors such as fear of fascinating a loss, or the desire to eke out a little more profit from a trade. Automated interchange helps ensure that discipline is maintained because the trading contemplate will be followed exactly. In addition, “pilot error” is minimized, for exemplification, an order to buy 100 shares will not be incorrectly entered as an order to tell on 1,000 shares.

-

Achieves Consistency. One of the biggest challenges in trading is to design the trade and trade the plan. Even if a trading plan has the potential to be fruitful, traders who ignore the rules are altering any expectancy the system would participate in had. There is no such thing as a trading plan that wins 100% of the loiter again and again – losses are a part of the game. But losses can be psychologically traumatizing, so a trader who has two or three shake off trades in a row might decide to skip the next trade. If this next commerce would have been a winner, the trader has already destroyed any expectancy the procedure had. Automated trading systems allow traders to achieve consistency by work the plan. (It’s impossible to avoid disaster without trading rules. For multitudinous, see 10 Steps to Building a Winning Trading Plan.)

-

Improved Order Memo Speed. Since computers respond immediately to changing market inures, automated systems are able to generate orders as soon as trade criteria are met. Put over in or out of a trade a few seconds earlier can make a big difference in the trade’s outcome. As at bottom as a position is entered, all other orders are automatically generated, including safeguarding stop losses and profit targets. Markets can move quickly, and it is demoralizing to attired in b be committed to a trade reach the profit target or blow past a stop impairment level – before the orders can even be entered. An automated trading way prevents this from happening.

- Diversifies Trading. Automated work systems permit the user to trade multiple accounts or various blueprints at one time. This has the potential to spread risk over various contracts while creating a hedge against losing positions. What at ones desire be incredibly challenging for a human to accomplish is efficiently executed by a computer in milliseconds. The computer is adept to scan for trading opportunities across a range of markets, generate demands and monitor trades.

Disadvantages and Realities of Automated Trading Systems

Automated pursuit systems boast many advantages, but there are some downfalls and realties that brokers should be aware.

-

Mechanical failures. The theory behind automated swop makes it seem simple: Set up the software, program the rules and watch it business. In reality, however, automated trading is a sophisticated method of trading, yet not sure. Depending on the trading platform, a trade order could reside on a computer – and not a server. What that tights is that if an internet connection is lost, an order might not be sent to the demand. There could also be a discrepancy between the “theoretical trades” initiate by the strategy and the order entry platform component that turns them into actual trades. Most traders should expect a learning curve when press into servicing automated trading systems, and it is generally a good idea to start with minuscule trade sizes while the process is refined.

-

Monitoring. Although it see fit be great to turn on the computer and leave for the day, automated trading systems do want monitoring. This is due do the potential for mechanical failures, such as connectivity deliveries, power losses or computer crashes, and to system quirks. It is possible for an automated buy system to experience anomalies that could result in errant reserves, missing orders, or duplicate orders. If the system is monitored, these events can be placed and resolved quickly.

- Over-optimization. Though not specific to automated trading systems, businessmen who employ backtesting techniques can create systems that look colossal on paper and perform terribly in a live market. Over-optimization refers to nauseating curve-fitting that produces a trading plan that is unreliable in viable trading. It is possible, for example, to tweak a strategy to achieve exceptional dnouement develops on the historical data on which it was tested. Traders sometimes incorrectly appropriate that a trading plan should have close to 100% remunerative trades or should never experience a drawdown to be a viable plan. As such, parameters can be put in ordered to create a “near perfect” plan – that completely fails as some time as it is applied to a live market. (For more, see Backtesting and Forward Testing: The Moment of Correlation.)

Server-Based Automation

Traders do have the option to run their automated buy systems through a server-based trading platform such as Strategy Despatch-bearer. These platforms frequently offer commercial strategies for sale, a wizard so salesmen can design their own systems, or the ability to host existing systems on the server-based policy. For a fee, the automated trading system can scan for, execute and monitor trades – with all lodges residing on their server, resulting in potentially faster, more certain order entries.

The Bottom Line

Although appealing for a variety of fittings, automated trading systems should not be considered a substitute for carefully liquidated trading. Mechanical failures can happen, and as such, these systems do be lacking monitoring. Server-based platforms may provide a solution for traders wishing to play down the risks of mechanical failures. (For related reading, see Day Trading Strategies for Beginners.)