In the past this week, it’s been more than eight years since Apple’s (AAPL) market capitalization (deal in cap or valuation) fell below that of its long-time competitor, Microsoft (MSFT). It happened most recently this previous Monday as the share prices of the two tech giants diverged further than they already had in recent weeks.

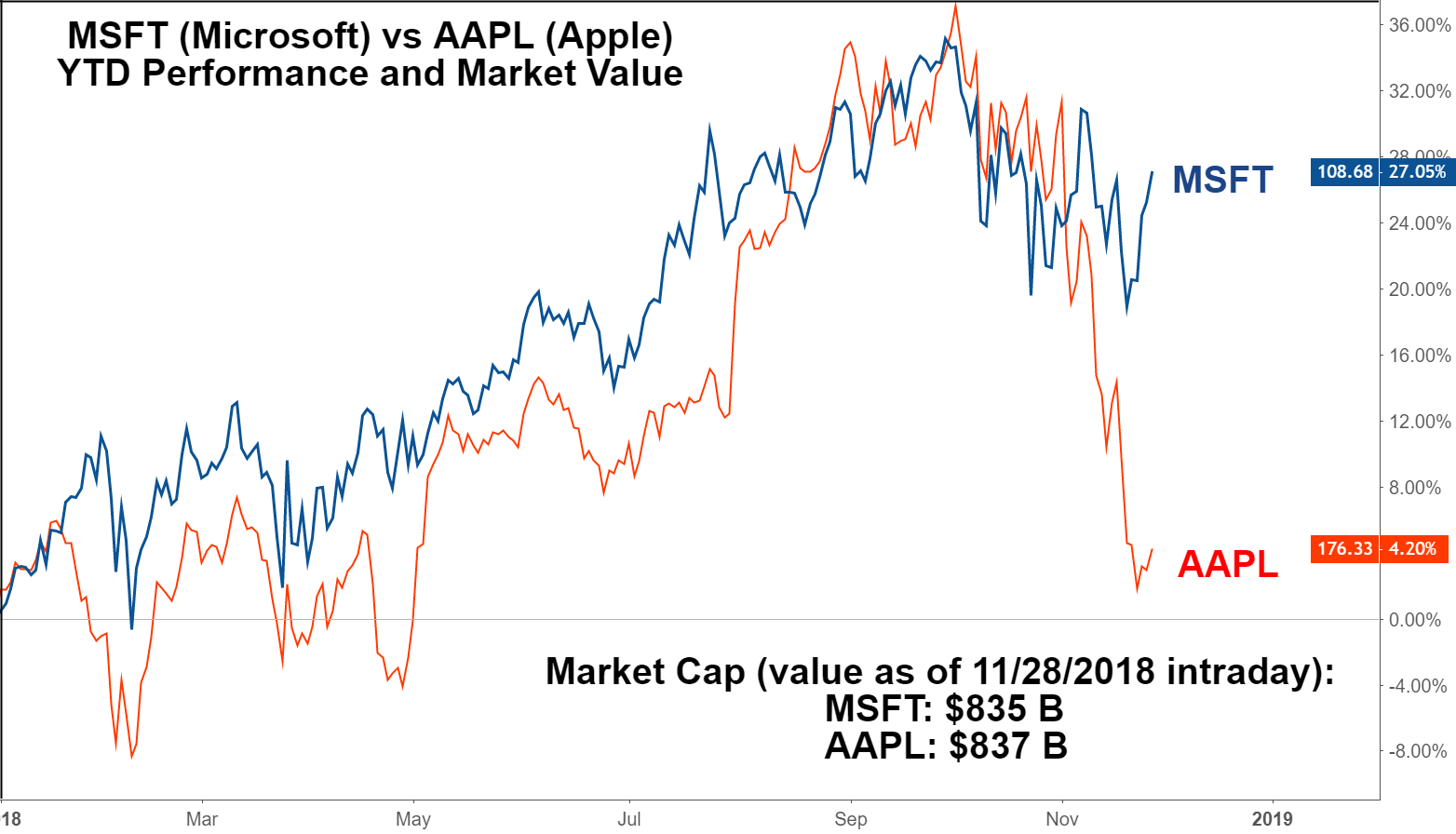

Apple’s cut price has been plunging this month on significantly lower sales and demand outlooks for its flagship products, most surprisingly the iPhone. Meanwhile, Microsoft’s stock has remained much more stable amid ongoing market volatility. The plot below shows the current price and year-to-date performance for both stocks. MSFT has surged by over 27% this year, while AAPL is now up at best a relatively scant 4% as of midday on Wednesday, November 28.

After Microsoft briefly edged out Apple on Monday, Apple’s valuation post-haste again regained slight dominance, but they’ve been neck and neck since then. As it currently stands on Wednesday, November 28, AAPL is on the contrary $2 billion higher in market cap than MSFT, which is virtually a rounding error.

What could this low for the never-ending rivalry between Microsoft and Apple? It was only in August that Apple reached its widely-acclaimed $1 trillion shop cap, and October when it reached a top modestly above $1.1 trillion. Since then, it’s lost almost $300 billion in make available value. At this rate, Microsoft appears prepared to assume the crown from Apple as the next $1 trillion performers.

Source: TradingView