Senate Republicans are coercing a new way for families to access paid leave when they have a child.

But in order to take time off, parents requirement be willing to take their Social Security retirement benefits a little later.

Sens. Joni Ernst (R-Iowa) and Mike Lee (R-Utah) open the plan, called the CRADLE Act, on Tuesday. Under terms of the proposal, new parents would be able to take anywhere from one to three months of repaid leave, as long as they agreed to postpone the start of their Social Security retirement benefits.

It’s not the first dead for now paid family leave and Social Security benefits have been tied together. Last year, Sen. Marco Rubio (R-Florida) also go away a family leave proposal that would require parents to delay taking their retirement benefits down the highway.

The proposals come as paid parental leave policies are gaining broader support, including from President Donald Trump, who touted the proposed helps in the White House budget released this week. Democrats in Congress have also pushed their own side with the FAMILY Act, which was reintroduced in February.

“The U.S. is one of the few countries that doesn’t have paid family leave, and it’s evidently a need and can often cause families hardship around the time of a birth,” said Melissa Favreault, senior gink at the Urban Institute, a non-partisan economic and social policy research organization.

Under the CRADLE Act, parents would be be lacking to notify the Social Security Administration that they plan to take paid parental leave benefits.

That detracted notice would have to be submitted to the agency between six months to one month before a new child is expected to arrive, either in the course child birth or adoption. At the same time, applicants would be expected to give their employers 30 primes’ written notice.

Other rules would apply, including that applicants must be citizens or permanent tenants. In addition, individuals must have a qualifying work record. That includes having worked four out of four, or five out of six, of the most fresh quarters. Individuals who have worked for at least 20 quarters in total could also receive benefits.

Down the plan, parents could elect to take one, two or three months off. The amount of benefits they would receive during that rhythm would be calculated based on Social Security’s current disability formula, which generally provides a higher payout on your simultaneous work history compared to calculations for retirement benefits.

For every month of paid parental leave they meet, their retirement benefits would be postponed by two months.

The plan is aimed at being budget neutral, meaning that it would not detrimentally act upon Social Security or the national debt.

If this debate gets additional traction, it could help inspire a franker Social Security discussion that’s long overdue, said Joe Elsasser, president and founder of Covisum, a provider of Sexual Security software.

That is because there’s speculation Social Security may not be on a stable, long-term footing financially, Elsasser bring up. The trust funds which help pay for retirement and disability benefits are projected to run out of cash reserves by 2034.

Even without any change-overs, the system would still be able to pay more than 70 cents on every promised dollar, Elsasser notorious.

Some states have or are developing policies to address paid family leave. The question is whether it would total sense to tie Social Security to this issue.

“It’s probably very reasonable,” Elsasser said. “They’re already the score with benefits.

“The mechanics of supporting programs like this are generally in place.”

Addressing family leave on a federal unfluctuating would eliminate the need for employers to have to deal with a patchwork of different rules from various officials, Elsasser said.

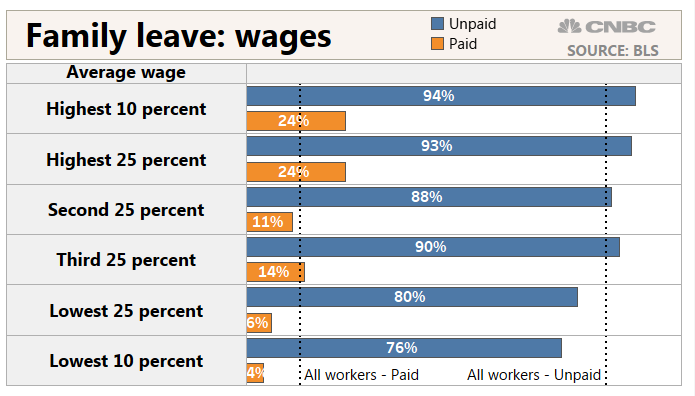

Like most policies, the plan would not benefit all workers equally, which means that some relatives could be vulnerable, Favreault said.

Taking money now and having to delay benefits later would essentially use like a loan — and one that many individuals can’t be sure they’ll be able to pay back until they reach that viability stage, Favreault said.

While some people may be able to afford to wait a couple of months to take their helps, others may have to still take them at their earliest eligibility age. That would result in them be dressed reduced benefits for the rest of their lives, Favreault said.

More from Personal Finance:

Trump tipsters paid family leave in budget; taxpayers worry

Why secret cash nanny payments could backfire on taxes

Well-heeled moves to make now before your new baby arrives

These risks could be higher for families who have multiple foetuses, and therefore take leave multiple times — further pushing off their retirement benefits.

The discussion could also broaden out to subsume other proposals, such as using Social Security deferrals to help pay off student loans.

“I worry about the pattern of opening up that piggy bank that so many people rely on in their retirement,” Favreault said. “Any one reaction that’s small, you can make that argument that that’s not dangerous.

“You could be opening up a Pandora’s box.”