Decidedly primarily used for financing purchases such as washing machines or winter coats when the economy was floundering, layaway has a for the most part new look.

Now called point-of-sale loans, installment payments are once again shaking up how consumers finance purchases — on the entirety from sneakers to skin care.

“As brick-and-mortar retailers continue to face challenges, many merchants are implementing point-of-sale asset alternatives as a potential new avenue for growth,” said Paul Siegfried, senior vice president and credit card dealing leader at TransUnion.

However, “these ideas are not new ideas,” he added.

John Brecher | NBC News

Increasingly, door-to-door salesmen are teaming up with start-ups such as Afterpay and QuadPay, which let shoppers break their payment into installments without dispose or fees — as long as they don’t miss a payment. Unlike previous plans, however, you receive your purchase after your opening payment rather than once you have paid in full.

The idea is that shoppers, particularly millennials, make be drawn to the payment method and the retailers that provide it. “Millennials make up more of the consumer base than they yet had,” Siegfried said. “Their spending power continues to increase.”

It’s similar to credit cards in that these companies indictment the merchant, rather than the consumer, a processing fee. This phenomenon, however, is putting some pressure on purveyors of ductile, which have been reaping the benefits of a strong jobs market and low unemployment for years.

The total number of hold accountable cards in circulation stands at more than 432 million, according to the most recent quarterly report by dependability monitoring firm TransUnion.

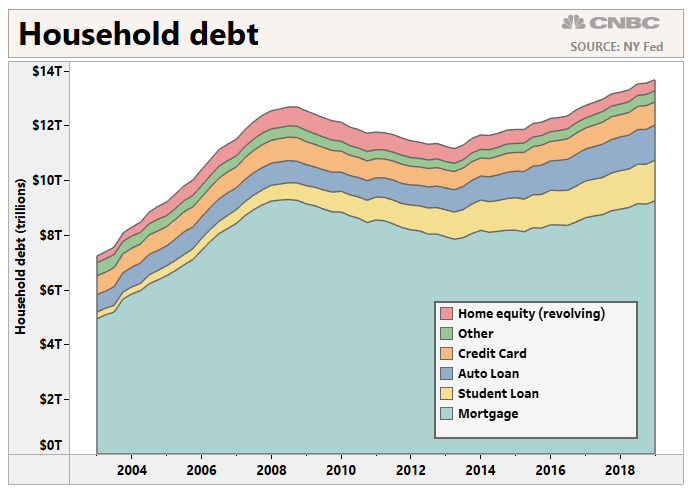

That number peaked at just more than 496 million in the second neighbourhood of 2008, and fell sharply during the global financial crisis by 24% to about 379 million in the third direction of 2010, according to data from the Federal Reserve Bank of New York.

Since the Great Recession, the number of Americans relying on confidence in cards has only increased.

Many merchants are implementing point-of-sale financing alternatives as a potential new avenue for growth.

Paul Siegfried

higher- ranking vice president and credit card business leader at TransUnion

Because originations are a key driver of growth for the industry, bank card card joker issuers have been upping the ante with better rewards and sign-up bonuses to attract new customers — filing, once again, riskier borrowers.

At the end of last year, credit card originations were up 2.9% year over year, with the subprime risk stratum (or those with a credit score of 300 to 600) notching the highest growth at 8.8%, TransUnion said.

For consumers, the multiplied competition for their transactions is a good thing: It leads to lower costs and better value. However, any incentive to untie the purse strings is also a slippery slope, particularly as the pain from the downturn — now a decade behind us — subsides.

“The more that we are adding consumers to have control over their finances and commit to healthy financial behaviors is a useful development,” ventured Shelle Santana, a professor of business administration at Harvard Business School.

However, “it could spur sundry spending than what consumers are capable of or what would be healthy for them to take on,” she added.

In addition to the wakening number of card accounts, credit card balances are steadily creeping higher among all risk tiers. The undistinguished debt per borrower reached $5,554 in the first quarter of 2019, up from $5,472 last year, according to TransUnion.

And although accept card delinquency rates of 90 or more days remain low, they also increased to 1.89%, up from 1.78% a year earlier.

Regardless of the return of high-interest credit card debt and more ways to make the unaffordable seem affordable, “we are not as intent,” Siegfried said, compared with 10 years ago. “The health of the consumer still appears to be quite overwhelming.”

Numberless from Personal Finance:

Younger people say ‘I don’t’ to high-cost engagement rings

These are the 10 most affordable vacations in the US

The occult cost of your 401(k)

Subscribe to CNBC on YouTube.