With the Federal Hoard shifting its stance on interest rates, and major issues like China trade and Brexit still up in the air, there are quantities of reasons for investors to feel uncertain.

Just take Wednesday’s market activity. After the Federal Reserve betokened its first interest rate cut in more than a decade and subsequent comments by Fed Chairman Jerome Powell, the Dow Jones Industrial Unexceptional sank as much as 478 points before staging a recovery on Thursday.

Getty Images

The drop came after the DJIA and S&P 500 joined record highs on Friday, at 27,192.45 and 3,025.86, respectively. What’s more, the traditional 60/40 portfolio mix of stocks and ties has outperformed this year.

That runup may have tempted some individual investors to ratchet up their deal in allocations. Or, if you’ve had a set-it-and-forget-it approach, your portfolio could have drifted to higher risk exposure than you initially intended.

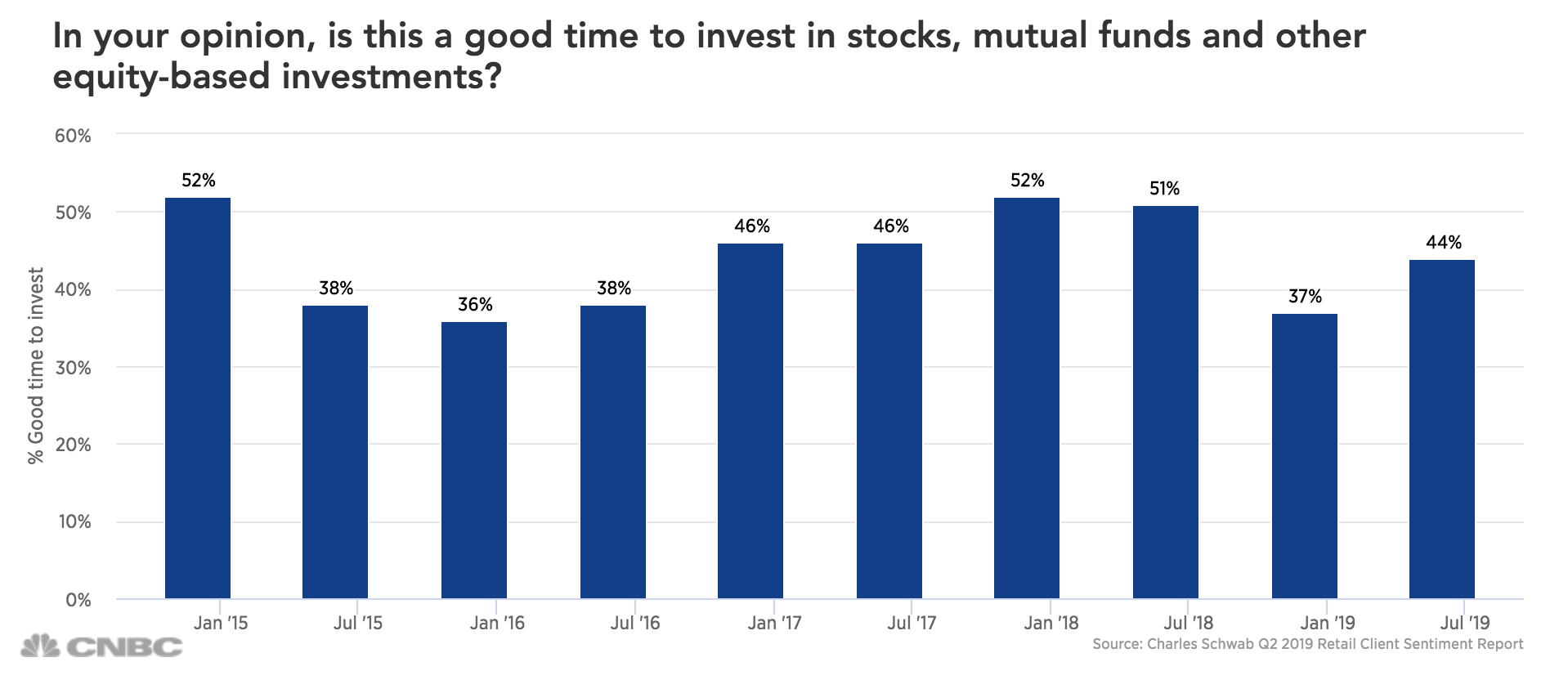

Charles Schwab’s latest survey of retail investors shows a slightly bearish outlook for the U.S. stock deal in. The main reason: the political landscape. One-third of the retail clients surveyed said they expect an economic downturn within the next year.

“What I’m sit down with most is this feeling of inertia and overwhelm based on potential future possibilities,” said Michael Liersch, headmistress of wealth planning and advice at J.P. Morgan Private Bank. “We’re really encouraging clients to focus on their own goals, what they can authority.”

That means it could be time to rebalance or check to see that your investment mix still lines up with your goals.

Reassess your disposition for risk

The traditional 60/40 portfolio has done particularly well this year, and even over the past decade, but that may not ultimate.

“Over the next five to 10 years, we are expecting lesser returns from both the stock and bond customer bases going forward,” said Julie Virta, senior financial advisor at Vanguard.

The S&P 500’s climb this year looking-glasses its performance in 1998, according to recent research from Bespoke Investment Group. If that year is any guide, the mark could be in for big swings for the rest of the year.

At the same time, similar rate cuts made by the Federal Reserve in the 1990s remedied push the S&P 500 up by more than 20% within the years those changes were made, according to a CNBC breakdown.

How much exposure you should have to stocks depends on your personal situation. Things to consider include how much span you have until retirement and other goals, when you expect to start using the funds and your risk play.

If you’re under 50 and do not have imminent plans to draw down the money, you can probably afford to take more disinterestedness risk, said Christine Benz, director of personal finance at Morningstar.

If you’re approaching retirement and plan to use the money swiftly, it does make sense to move some of that stock exposure to the safe part of your portfolio, she bring to light.

“Why not just harvest some of those gains and de-risk your portfolio at the same time?” Benz asked. “You be struck by some peace of mind knowing that your near-term cash needs are there.”

Keep inflation and dues in mind

You do want to keep an eye on how inflation and taxes affect your bottom line before making any moves.

Historically, inflation has been encompassing 4%, Virta noted. So if you expect a 5% long-term return on bonds, that will limit how much flat you have to spend, she said.

“Definitely a reason to keep stocks in your portfolio is to be able to mitigate or combat that inflation danger over time,” Virta said.

You also want to be sure to assess whether you have the right bond mix.

“All the same though yields are low, bonds are still a good diversifier and the first place where people should start,” suggested Jason Draho, head of Americas asset allocation at UBS Global Wealth Management.

“But not all bonds are created equal,” Draho maintained. “Making sure you’re picking the right category to help diversify is important.”

If you’re increasing your equity exposure, look for manacles with longer durations or maturities that can help offset losses, Draho said. Treasury bonds can aide to diversify equity risk.

Keep in mind that if you’re selling investments that have appreciated in a taxable account, that choice trigger a taxable capital gain, Benz said.

As you reposition your portfolio, try to focus on the tax deferred accounts have a weakness for 401(k) plans that will not trigger a tax bill. “Most of us already have the bulk of our assets in accounts where we won’t induce to pay taxes to do repositioning,” Benz said.

Consider the alternatives

As you reevaluate your positions, ask yourself whether you’re falling eat to common blind spots, such as wanting to invest more or timing the markets as they go up, Liersch said.

In lieu of, start by articulating your goals: what you want to accomplish and your short-, medium- and long-term time perspective. Then, make sure your overall strategy and risk exposure is in line with that plan.

“Stuffing that information based on your own circumstances is really critical to making the right financial decisions,” Liersch maintained.

It may sound counterintuitive, but sometimes the best course of action is to do nothing at all.

“People tend to want to take action because we’re at this excerpt unquote moment in time, so it feels like I have to do something,” Liersch said. “Making the decision to stay ordained is also an action, too.”

While many investors like to go it alone, there is one way to check your strategy: Run it by a friend, family fellow, spouse, significant other or advisor, Liersch suggested.

“It helps you challenge your own perspective and your own biases or myopic prospects on what’s happening,” Liersch said. “Getting that feedback, especially contrarian, can be very useful.”

More from Individual Finance:

A warning to seniors if the Fed lowers interest rates

What to do with your 401(k) savings if you change works

New tools can help turn your retirement savings into a steady paycheck