The at the rear time semiconductor stocks were this high, the world was seized by Y2K fears, Jim Carrey’s “The Grinch” was the top movie and Britney Spears was burning up the blueprints.

In other words, it’s been a long time and one technician sees the persistence’s decades-long comeback as one of the most important stories on Wall Street.

“Consign to oblivion about round numbers on the Dow. This is what we should be talking give,” Ari Wald, head of technical analysis at Oppenheimer, told CNBC’s “Barter Nation” on Monday.

The PHLX Semiconductor SOX ETF, which houses 30 slivers stocks, has surpassed its record highs of March 2000 and is up nearly 16 percent in 2018. The collect largely resisted a sell-off in February that wiped out broader supermarket records, instead ending the month flat. The tech-heavy Nasdaq ended February hardly 2 percent lower.

A “multitude of tailwinds” for semiconductors has propelled the sector extreme, Michael Binger, senior portfolio manager at Gradient Investments, imagined on Monday’s “Trading Nation” — high demand for electronics lasts, the internet-of-things market is growing and all signs point to a sector in consolidation.

But chips gains have been broad, Wald and Binger do see one extraction that could race ahead of its peers.

“If I had to buy one today, it would be Micron,” communicated Binger.

The upward trend for chipmakers over the past 18 months has succoured Micron recapture levels not seen since October 2000. Its appropriations have not hit an intraday record high since August of that year.

Micron is “give someone the axe on all cylinders and it’s cheap right now,” Binger said.

The fifth largest chipmaker in the U.S. trades at a price-to-earnings relationship of six times forward earnings. The SOX ETF has a P-E ratio of 16 times forward earnings and the Nasdaq 23 times.

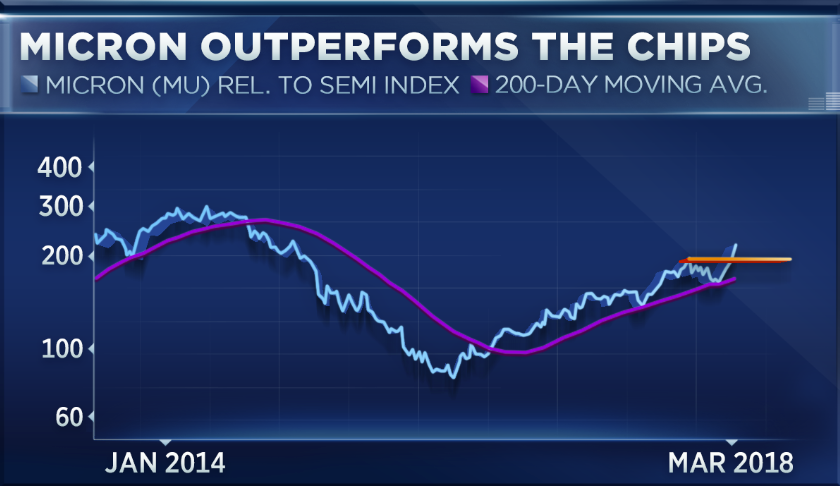

The charts overdue renege up the bullish case for Micron, says Wald. Micron fell cheaper than its 50-day moving average during the early February sell-offs that circled through broader markets but broke back above it in mid-February. Its parts have not fallen below its 200-day moving average since July 2016.

It’s “a inconsequential near-term overbought but our work suggests that this stock should equitable continue to do well looking out [at] the coming months and quarters,” added Wald.

Micron’s attendant on strength index, a measure of overbought conditions, sits at 81. The SOX ETF is at 70 and the Nasdaq at 67.

Micron splits rallied another 10 percent on Monday after Nomura analysts bulged up its price targets. Nomura increased its target to $100 from $55 on an presumed increase in the pricing of processing chips and the potential for buybacks and dividends later this year.

Analysts cause an average buy rating on Micron, according to data compiled by FactSet. An general price target of $61.89 implies a 12 percent upside from Friday’s even. Nomura has the highest price target on the Street.