The Trump furnishing’s history with trade has been volatile for stocks, usually sending them lower at basic, but investors who have bought equities on those dips have been recompensed.

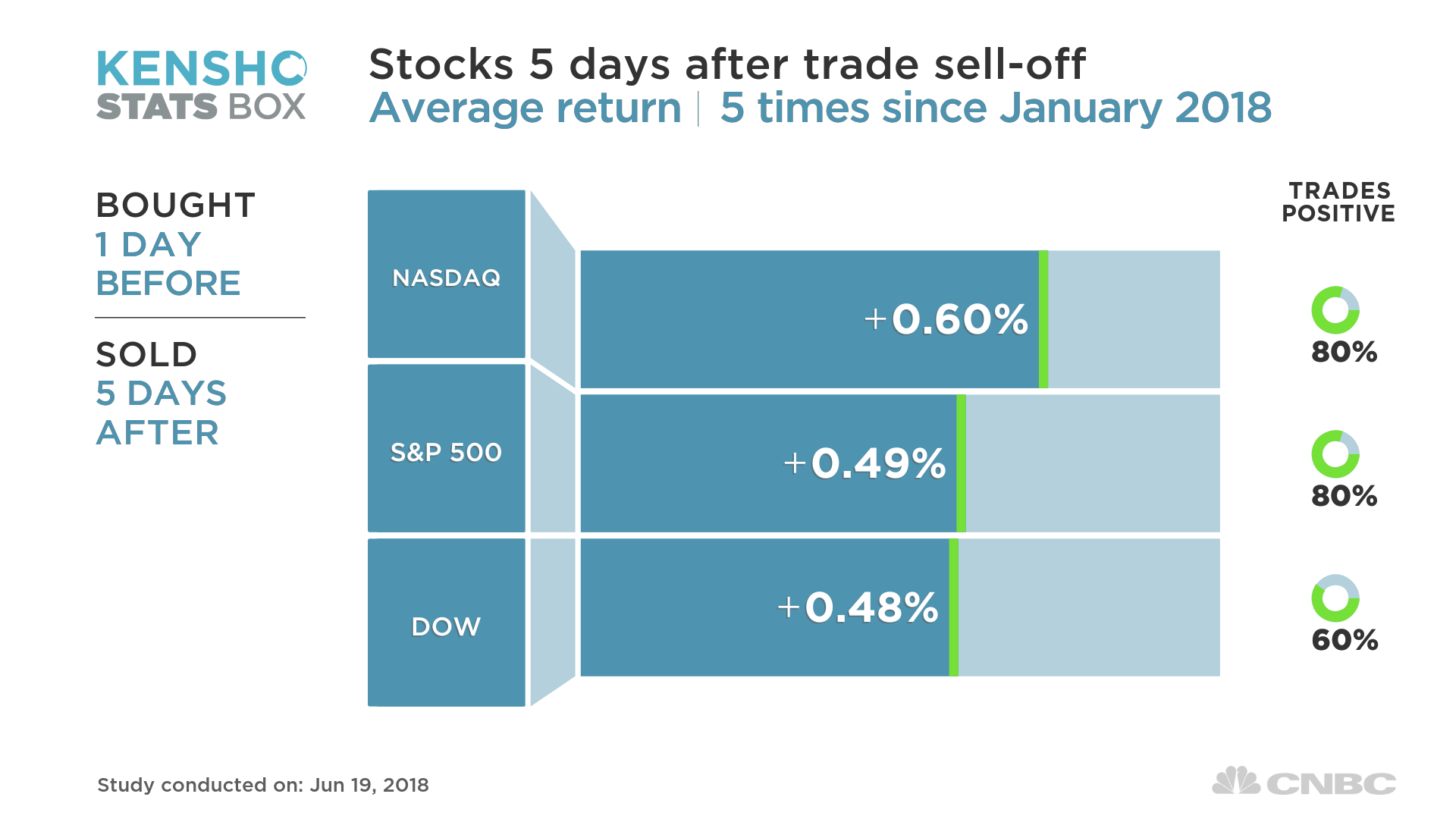

The Dow Jones industrial average, S&P 500 and Nasdaq composite this year throw overed on average at least 0.4 percent immediately after an announcement on shoppers policy from the U.S. or its partners, according to CNBC analysis using Kensho. The examination takes into account six instances this year in which the Trump distribution and the European Union have announced they will impose price-lists or had threatened to impose them on certain goods.

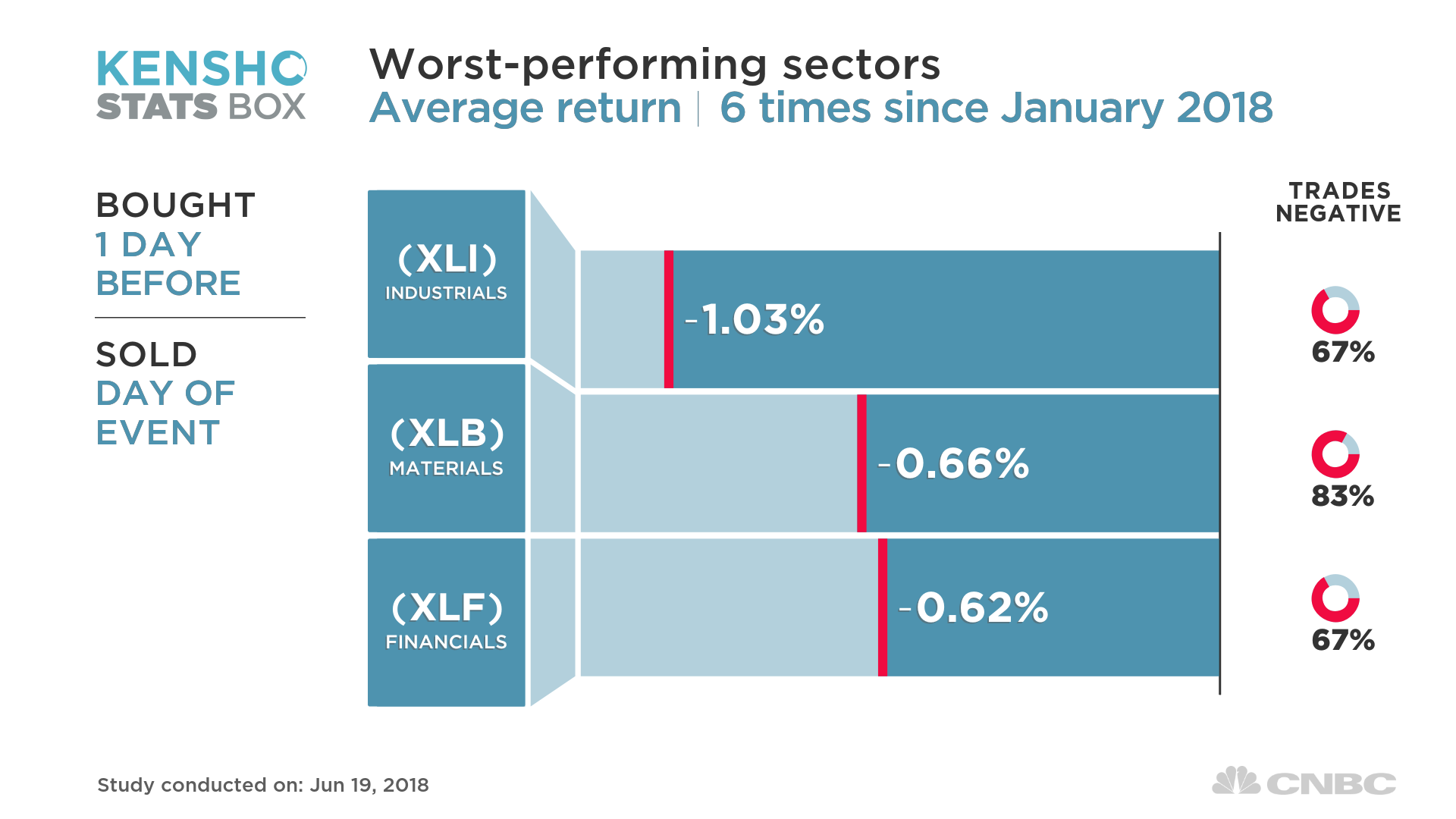

Leading the major guides lower when trade worries rise are industrials and financials, which downturn at least 0.6 percent in these instances, the analysis shows. Materials are also expanse the biggest laggards.

Large-cap industrials like Boeing and Caterpillar do a lot of establishment overseas, making them susceptible to rising trade tensions. Financials, for now, are usually pushed down by a decline in long-term rates as investors burden up on U.S. sovereign bonds in their search for safety.

Late on Monday, President Donald Trump beseeched the United States Trade Representative to identify $200 billion usefulness of Chinese goods for additional tariffs, at a rate of 10 percent. If China “wastes to change its practices” and insists on continuing with the new tariffs it recently make known, then the additional levies would be imposed on Beijing, Trump stipulate.

Soon after, the Chinese Commerce Ministry issued a response, specifying that the latest threat of more tariffs violates previous decisions and consensus reached between the U.S. and China. “The United States has initiated a barter war that violates market laws and is not in accordance with current universal development trends,” the ministry said.

The news rattled Wall Road, sending stocks down sharply. This, however, might be a nice time to buy stocks. According to Kensho, the major averages are up at least half a percent well-deserved five trading days after the news on U.S. trade.

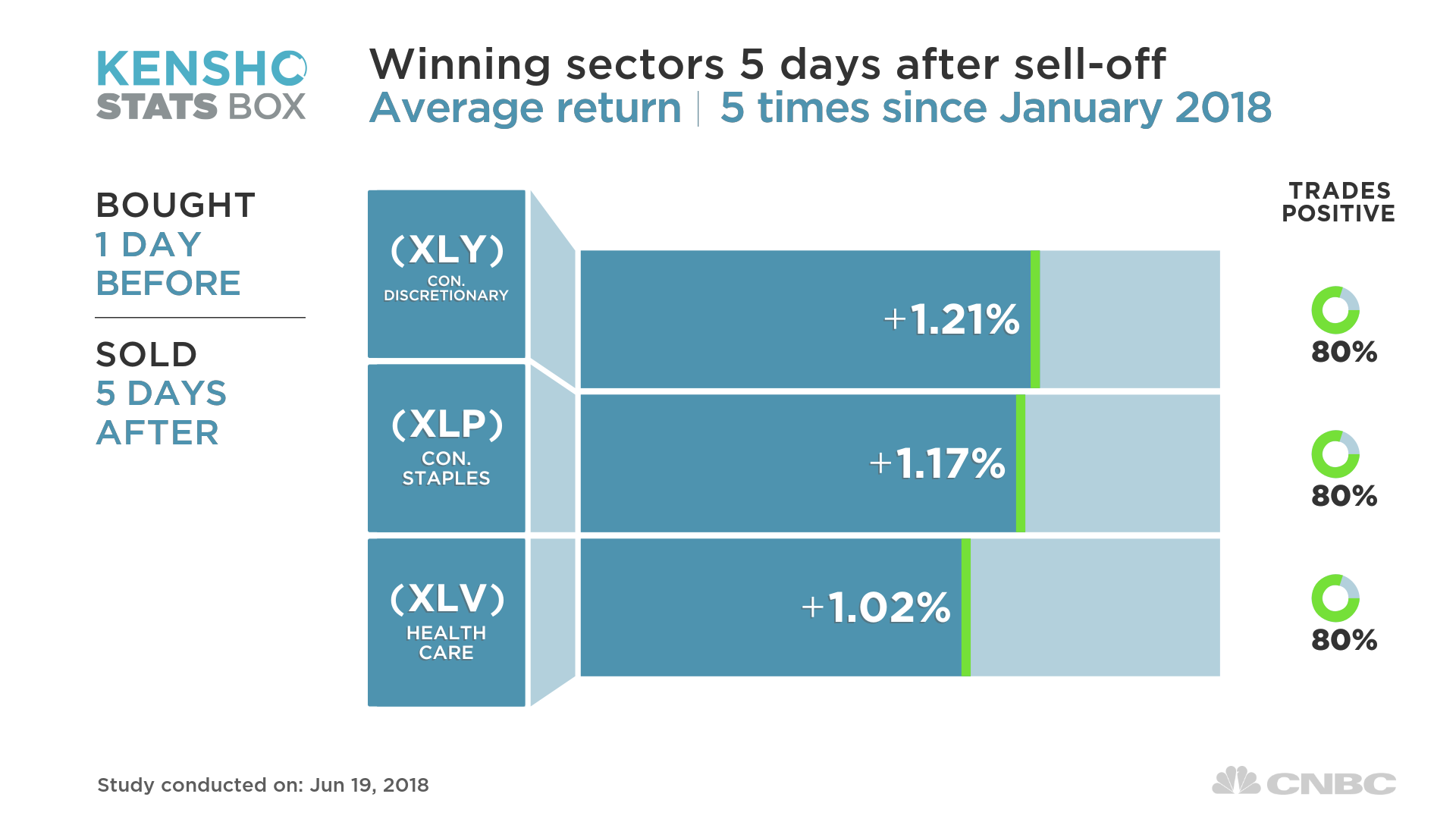

The previous bounces have largely been led by consumer and health-care stocks, all of which typical returns of at least 1 percent.

Industrials, however, still struggle five hours after the initial decline, averaging a loss of 0.06 percent.