TradingAnalysis.com originator Todd Gordon said that the market is potentially on the verge of a greater move out of a consolidation phase, and there’s one sector that he sees disavowing out.

Of the 11 sectors of the S&P 500, Gordon believes consumer discretionary is set to make a comeback along with the broader market. The chart-minded trader suggested that this team of stocks could be a less volatile way to ride the market higher. Here’s why:

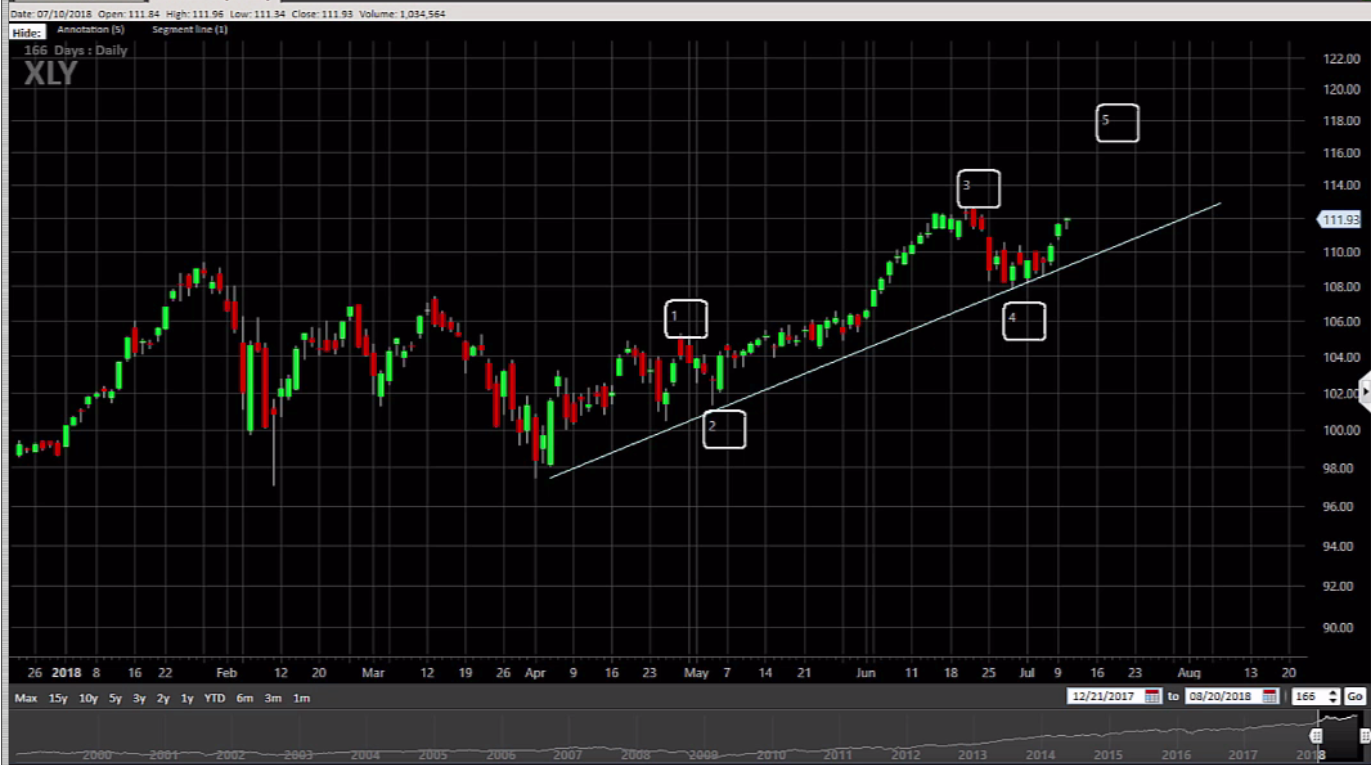

- On a map of the consumer discretionary-tracking ETF (XLY), Gordon points out that XLY needs to complete the fifth and last wave of the Elliot Wave theory. The classic theory, in this cover, would mean that XLY would need to make one final recover higher.

- Gordon then draws a line connecting XLY’s recent downcasts and duplicates the line to make a parallel channel. The trader sees XLY rallying up to the ceiling of the means to around $117.

- As a result, Gordon wants to buy the August monthly 112-strike knock up a appeal to and sell the August monthly 117-strike call for a total price of $1.77, or $177 per options spread.

- If XLY closes above $117 on Aug. 17 close, then Gordon could make a maximum reward of $323. If XLY unites below $112, however, he would lose the $177 he paid for the trade.

The clientele: Gordon is suggesting buying the August monthly 112/117 call spread for connected with $1.77, or $177 per options spread.

Bottom line: Gordon look afters XLY rising above $117 on August expiration.