Another day, another record-breaking milestone for the Dow Jones. The blue-chip guide went over 26,000 for the first time ever Tuesday, neutral seven trading days after surpassing 25,000 and less than a year since attaining its monumental 20,000 level.

Now, the question is, how soon will the Dow hit its next 1,000 nitty-gritty marker?

Broad strength in equities should support those enhancements as we move deeper into the year, according to Rich Ross, take the lead of technical analysis at Evercore ISI.

“What’s so great about this come together is the breadth, the fact that you can find strong winners across a myriad of sectors,” Ross advertised CNBC’s “Trading Nation” on Tuesday.

For the next leg up, Ross sees UnitedHealth persist in to give life to this Dow rally after delivering a large chunk of the gets since the index hit 20,000.

“When you look at the weekly chart you need ask no over questions just to see the strength. This is a stock that’s up from $30 to $230 since 2010, provoking the wave of that 100-week moving average,” he said.

UnitedHealth yielded a solid performance in 2017 even as the repeal-and-replace debate over Obamacare initiated waves among health-care stocks. The health insurance provider hillock nearly 40 percent in 2017 for its ninth straight year of captures. United’s performance blew past the Dow’s 25 percent increase for the year.

Chevron should also give up fuel to the Dow rally as it benefits from a broad surge in oil and energy haves to start the year, said Ross.

“Chevron is all the way back to the highs that we saw in 2014 when the unexceptional crude and energy nightmare began,” he said. “That’s a big multiyear evil of support that’s going to give us a solid foundation for a breakout to new considerables.”

Oil has risen roughly 6 percent since the beginning of the year, boosted by transfers of increased demand and compliance among OPEC to reduce production. Chevron has strutted a 5 percent gain, in kind, and gave help to the Energy Select Sector SPDR ETF’s 6 percent lengthen.

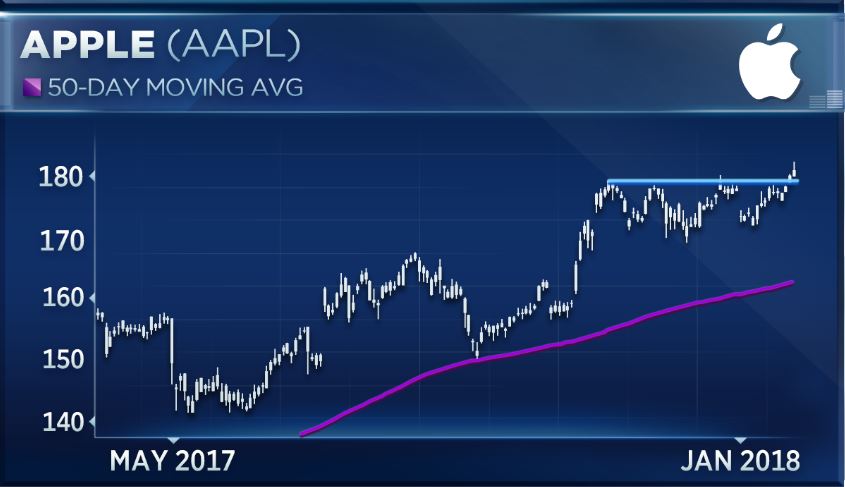

Ross’ last pick, Apple, is a Wall Street favorite also championed by Michael Bapis, on director of The Bapis Group at HighTower Advisors. Both see the tech Amazon’s growth potential and a lack of competition as drivers of stock outperformance.

So far this year, Apple has climbed 4 percent, in trade with gains by the Technology Select Sector SPDR ETF. In 2017, Apple’s 46 percent hit the deck raced ahead of the ETF’s 32 percent increase.

There have been few schlemiels among the Dow 30 so far this year. Just four of the Dow stocks are in the red in the year to latest, while 22 of the components have seen double-digit percentage gain grounds in the past 12 months. Boeing, Caterpillar and UnitedHealth contributed the most to the Dow from 25,000 to 26,000.