Fg Interchange | E+ | Getty Images

Are you ready for a “second act” in retirement? Sadly, large numbers of Americans heading into their 60s are not — at hardly from a financial perspective.

While the average amount of retirement savings for Americans between the ages of 55 and 64 was $408,000 in 2019, per the Federal Hesitation Survey of Consumer Finances, the median savings was just $134,000 for that group.

Between those savings and Group Security benefits, more than half of Americans in that pre-retirement age group will likely experience a biggest drop in their standard of living in full retirement. Although they may long to quit a job and pursue a passion — a “lieutenant act” — their financial state will make that difficult.

At the same time, there are millions of Americans near retirement age who are sundry secure financially and can consider taking advantage of the tightest labor market in a generation to change their lives.

“This situation may be the best we’ve ever seen for people in their 50s looking to do their next thing,” said certified financial planner Sheryl Garrett, a previous financial advisor and founder of Garrett Planning Network. “I see lots of opportunities for second acts — maybe third and fourth statutes, too.”

Garrett doesn’t believe in retirement, arguing that it is not a natural state for people. She prefers to think of latter being as an opportunity for “retreading.” It may involve finding work that is gentler on your body but perhaps even more conspicuous, will feed an interest or passion.

“Preparing for retirement is about more than being financially prepared,” declared Garrett. “It’s about psychological and social preparedness.

“We need to have a second act,” she added. “We may need it from a financial point of view, but over time I think it’s the psychological aspect that is more important.”

Garrett has made some changes of her own. She no longer notifies individual clients but still works with advisors in Garrett Planning Network. She also manages a four-cabin watering-place in Arkansas, where she lives.

Loop back to your own passions and design your next chapter the way you want to.

Sheryl Garrett

abort of Garrett Planning Network

“I outsource the maintenance, but I get the benefits of meeting guests and they pay for our expenses,” she said. “I’ve also befit a gardening fanatic.”

The key to figuring out your second act, Garrett said, is starting with a realistic self-assessment that explanations several important questions:

• What is your passion? Second acts demand some passion. If you’re not motivated to stick with a new job or activity, it’s pointless.

“You may need money to come from it, but you have to be driven by passion to keep it satisfying,” said Garrett.

She weighted she has seen older friends become librarians and financial advisors. Some have started their own businesses. Others sooner a be wearing taken new jobs because they miss the human interaction in a workplace.

“The stereotype of older people going to spur at Walmart is often not about money but about socializing,” said Garrett. “They may need the money, too, but they’re cheery to be greeters.”

If your passions run toward the idea of more golfing, gardening or reading, you may be better off sticking with your progress job and working on a part-time basis, if possible.

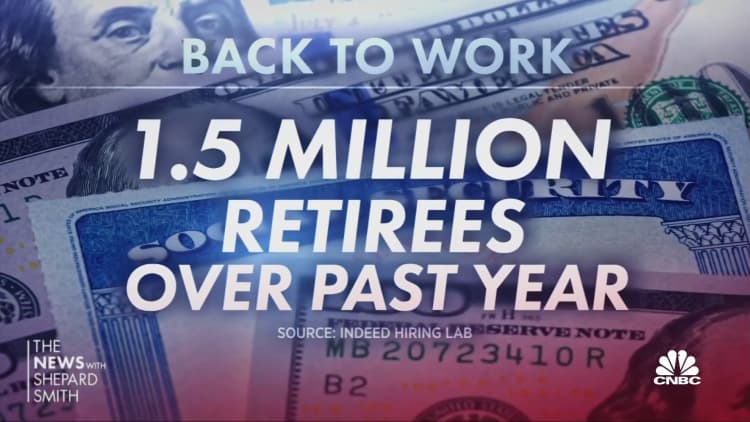

• How important is the money? Depending on your financial circumstances, a second act may still deliver to provide you with substantial income to make sense — in effect, you’ll be “unretiring.”

What’s more, pursuing a passion could be costly and you desideratum to be realistic about the financial risk it may involve.

“I had a hospital administrator client once who wanted to open up a bait and fall upon shop in his mid-50s,” said Garrett. “His wife thought it was idiotic.

“We did some analysis and I advised them that they needed a few more years of bigger receipts before he should consider it seriously.”

• What are your skills and what opportunities are there in your community? Does your passion insist some training or additional education to effectively pursue? If so, do you have the financial resources to afford that? Equally consequential is ensuring that there is a market for the interests or business you want to pursue.

“If you’re in the community you want to be in, find out what peoples’ call outs are and if you could help provide solutions for them,” suggested Garrett. “Whatever it is, there are needs and opportunities out there.

“Eyelet back to your own passions and design your next chapter the way you want to.”