Uncountable American workers are optimistic about their retirement goals, but most believe it will be challenging for them to give up working comfortably.

Almost half, 44%, of workers in a new CNBC poll are “cautiously optimistic” about their ability to competition their retirement goals, and 27% say they are “realistic” about that happening.

Even so, 82% of workers in that investigate say achieving a comfortable retirement is “much harder or somewhat harder” to achieve than it was for their parents. A majority, 69%, are caring about being able to afford to stop working or retire fully and 80% worry that Social Gage will not be enough to live on in retirement.

The CNBC report, conducted by SurveyMonkey, polled 6,657 U.S. adults, including 2,603 who are be given the gold watched and 4,054 who are working full time or part time, are self-employed or who own a business.

The decline in traditional pensions, the rising payment of health care and increasing life expectancy have contributed to workers’ need to rethink their retirement sketches.

“Retirement itself is being retired,” said Joseph Coughlin, director of the Massachusetts Institute of Technology AgeLab. “Much, within a year, two years, they found out that, frankly, they either need more money or have need of something to do.”

Here are smart moves you can make at every age to make it easier to meet your retirement goals:

In your 20s & 30s: Add to tax-advantaged savings

Many younger workers in the CNBC poll — including 43% of Gen Z and millennials, who are in their 20s to early 40s — are “cautiously expectant” about their ability to meet their retirement goals.

For people in their 20s and 30s, “retirement” is far away and means begetting the financial freedom to be “working because we want to, not necessarily because we have to,” said certified financial planner Rianka Dorsainvil, initiator of YGC Wealth in Lanham, Maryland, and a CNBC Financial Advisor Council member.

Starting to invest for retirement early, signally in tax-advantaged accounts, helps you make the most of your time investing in the market and leverage the power of compound involved in.

Various work opportunities can offer flexibility in options to save for the future. Many people in their 20s may work a 9-to-5 job and have on the agenda c trick a “side gig” or part-time job in the evenings or weekends.

That means you could save in a 401(k) plan at work as well as a self-employed retirement representation, like a simplified employee pension-individual retirement account or Solo 401(k) on your own, said Nate Hoskin, a affirmed financial planner and founder of Hoskin Capital in Denver.

While you may have opened a 401(k) plan in your beginning job, aim to increase the percentage you contribute each year. Put in at least enough money to get the company’s full matching contribution.

Time-honoured IRAs and 401(k) plans give you an upfront tax break. Making contributions with pretax money lowers your taxable return now, but you’ll have to pay taxes when you withdraw the money in retirement at your future tax rate.

Roth accounts, which let you forward after-tax dollars that then grow and can be withdrawn in retirement tax-free, can also be a smart bet for young workers who limit.

Lordhenrivoton | E+ | Getty Images

In your 40s: Monitor rising expenses

While you’re in your peak earning years, expenses can also elevation quickly. About half, 52%, of millennials and 47% of Gen Xers in the CNBC poll said “paying off debts or advances” is the main reason they feel behind in retirement planning or savings.

In that case, “it’s probably time to reassess pecuniary goals,” said Dorsainvil. Focus on paying down credit card and high-interest debt and boosting your crisis savings so that you won’t be forced to dip into retirement savings for unexpected expenses.

Also, be careful of “lifestyle creep.” You don’t not need to spend more just because you are making more. Don’t let the cost of your lifestyle increase faster than your receipts. See what expenses you can reduce or cut out.

In your 50s: Estimate your retirement income

The CNBC poll finds that 48% of GenXers expect to have saved $500,000 or more for retirement, yet the same share have currently saved $50,000 or less. Precisely 20% of this age group are “not sure” how much money they will need to spend each year on flaming expenses and other purchases in retirement.

In your 50s, it’s time to turbocharge your savings and start crunching the numbers to ascertain how much income you will have in retirement.

“Not enough people actually do financial planning, so they’re not aware of the bevies that they’re faced with early enough,” said Catherine Valega, a CFP and founder of Green Bee Advisory in Winchester, Massachusetts.

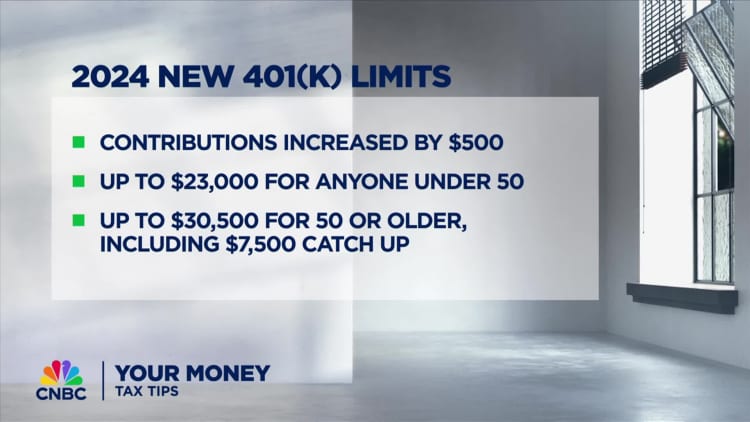

Starting at 50, you can as well your retirement savings with “catch-up” contributions. In 2024, the maximum you can contribute to a 401(k) is $23,000, but the IRS allows you to add an especially $7,500 if you’re 50 or older. For an individual retirement account (IRA), the maximum contribution for 2024 is $7,000, with an additional $1,000 if you’re 50 or older.

Online computers can show you how much your retirement savings might grow between now and your anticipated retirement, and how much that match might provide in monthly income. Also, factor in how much money you may get from Social Security.

Even if you over recall you’re behind in saving, estimating your retirement income presents an opportunity to figure out how to make it work, said Valega.

“We’re not universal to dwell on what you’ve done in the past. Let’s start today with what we have,” she said. “What are our assets? What are income-producing aptitudes, capabilities? And then we’re going to move forward.”

In your 60s: Test-drive your retirement

Shapecharge | E+ | Getty Spits

While 38% of baby boomers in their 60s and 70s say they are “on schedule” with retirement planning and savings, according to the CNBC ballot, 41% say they are “behind schedule.”

As you enter your 60s, and are closer to retirement, take your retirement for a test-drive. Over about what you will do, who you will do it with and where you will do it.

For example, Coughlin said to ask yourself: “What wish you do on any given Tuesday? There will be many Tuesdays with expenses, challenges and opportunities.”

Many people today breathe well into their 90s and beyond. While travel, pursuing hobbies and interests and spending time with strain are what most people of all ages say they will “ideally” do in retirement, the CNBC poll finds those who remember they will “realistically” be able to do so are much lower.

Once you identify your aspirations, do a test run of the lifestyle and the fingers on. Use your time off from work to engage in activities you think you’d like to do and vacation in the places where you think you’d get pleasure from to live. Also, test drive your retirement budget by comparing housing, transportation, food, entertainment and robustness care costs in that area to what you’re paying now. See if you can stick to that new budget for a few months while still employment.

No matter your age, Hoskin said, stick to some basic rules to achieve financial security: “You still lack to spend less than you make, save a significant portion of your income, locate that money in the conventional accounts, and invest it for the future,” he said. “That is the cycle that creates generational wealth.”

SIGN UP: Money 101 is an eight-week knowledge course on financial freedom, delivered weekly to your inbox. Sign up here. It is also available in Spanish.

Represent NOW! Join the free, virtual CNBC’s Women and Wealth event on Sept. 25 to hear from financial specialists who will help fund your future — whether you are returning to the workforce, starting a new career or just looking to revive your relationship with money. Register here.