Genesis Worldwide Trading’s cryptocurrency lending arm continues to grow – and diversify beyond short sellers.

Announced Thursday, Genesis Far-reaching Capital wrote $425 million of crypto loans in the first quarter, bringing its total originations since the point launched in March 2018 to $1.53 billion.

Moreover, Genesis’ portfolio of outstanding loans grew 17 percent from the end of after year to $181 million as of March 30. (The average loan is paid off in six weeks, which explains why the amount important at the end of the period is so much smaller than the volume produced during the quarter.)

Of that loan book, bitcoin-denominated credits made up 68 percent, XRP loans 6.7 percent and ethereum and litecoin loans 3.6 percent each.

But maybe most notably, short sellers now account for only 3 to 5 percent of Genesis’ bitcoin loans, down from hither half in early 2018, Michael Moro, the CEO of Genesis’ trading and lending businesses, told CoinDesk.

The ability to carry crypto short, or bet that its price would fall by selling borrowed coins, “was a missing piece for a long time, something that exists in any other existing established world. You can short gold, stocks, why can’t you short cryptocurrency?” Moro averred, explaining why Genesis’ loans were initially so popular for this purpose, adding:

“But this speculative bet on the downside of bitcoin started to Poetic evanish towards the end of 2018 and now it doesn’t exist.”

The predominant category of borrowers for Genesis now is exchanges and over-the-counter (OTC) trading desks, which enter to keep clients’ funds in cold, or offline, storage and settle trades with borrowed coins, he said.

Altcoin testy

If interest in shorting bitcoin has dwindled, that’s not the case for other cryptocurrencies.

“Short sellers pretty much be found in altcoins: ether, litecoin,” Moro said. “Maybe there is some kind of bitcoin maximalism built-in in hanker term, or the cost of shorting it is too high.”

There was also “a lot of short interest in XRP” during the third quarter of 2018, “but that rage steadily diminished towards the end of the year and hasn’t reignited thus far in 2019,” according to Genesis’ quarterly report disseminated Thursday.

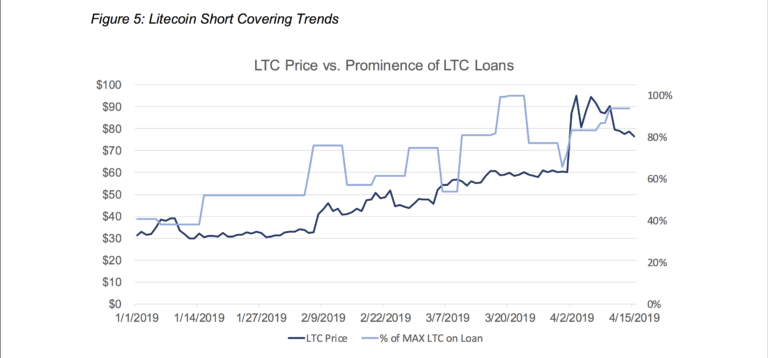

In the report, Genesis shows a clear correlation between the price movements and borrowing activity of the company’s patients. And as ether and litecoin prices go down, the amount of loans rises, Genesis’ charts show.

Interestingly, shorting models for different cryptos vary, the analysis shows. For example, for bitcoin, so far in 2019 there is little correlation to be seen between the measure of loans and the price.

For ether and litecoin, the link is clearer: as the price declines, people borrow more coins, and as it spoils up they pay back the loans. However, “unlike ETH, LTC borrow returns preceded major rallies rather than grow fainted – indicating better information or better understanding of momentum in the asset,” the report says.

For example, in early February, there was an uptick in ether in a nutshell bermuda short when the coin was trading at $100; “loans outstanding ballooned to the highest level over the quarter,” the report voices. They dropped 30 percent on February 7, after the price went up to $120. A week later, the toll rallied again to $140, lowering the appetite to short.

“Our borrowers likely covered shorts after [the] price had already on the ran against their positions,” the report suggests.

As for litecoin shorting: in mid-March, clients borrowed a lot as the price was around $60, “another steady speculators believed to be a top. But that belief was not correct and yet again, the shorts covered before the price rallied swiftly to $90. A charge out of prefer clockwork, they re-engaged after the price established itself in the $80-90 range,” the report says.

Lending fiat, too

Genesis draws crypto from “whale” investors, including some individual early bitcoiners, Moro said. The firm sponges at a 4 to 5 percent interest rate and lends at 6.5 to 7.5 percent; the interest is paid in crypto.

The company doesn’t over b delay these coins in cold storage, Moro said: As soon as a borrower pays back crypto, it gets bestowed out to another client as soon as possible from the hot wallet.

“Every coin we have is for lending,” he said.

Another, newer enter in of Genesis’ business is fiat loans, although it’s still in a pilot phase. Launched at the end of 2018, cash loans now account for 10 percent of Genesis’ portfolio.

The patrons on this side are hedge funds that want to get some extra operational cash without using their customers’ funds, Moro says. They post 120 percent collateral in crypto and are subject to margin calls if the fiat value of it resort ti below 105 percent.

The crypto lending market is starting to get more competitive, with firms like BlockFi and Celsius minuting the fray. Moro believes the popularity of crypto loans and crypto-collateralized cash loans is due to the fact that investors inadequacy to hold their bitcoin, and to the general maturing of the market.

He concluded:

“No one wants to sell bitcoin and people want multitudinous of it. As for the institutional investor crowd, many entered the market in 2017, and they are used to [being able to] go long and go underfunded, so you have a match of people who want to lend and borrow. Back in 2014-2015, we didn’t have borrowing request, these people just were not in business yet.”

Michael Moro image via CoinDesk archives