The totality value locked in decentralized finance (defi) has managed to jump above the $200 billion zone, as crypto deal ins have rebounded from the market downturn last week. A number of native assets from the $611 billion significance of smart contract protocols have seen double-digit gains with cypherium (CPH), counterparty (XCP), and terra (LUNA) outstanding the pack.

TVL in Defi Jumps Back Above $200 Billion — Cypherium, Counterparty, Terra Rise

Crypto stock exchanges have recovered after initially dropping after Russia invaded Ukraine three days ago and the rebound has raided defi value up as well. After falling beneath the $200 billion mark, the total value locked (TVL) in defi has holed back above the zone to $200.94 billion on February 27.

The TVL in defi across all the top blockchains hit a low of $185.9 billion on January 28 and it’s up 10.61% since that day. Curve dominance is 8.68% on Sunday with $17.86 billion full value locked but the defi protocol’s TVL is down 5.61% since last week.

Ethereum dominance, in terms of the TVL in defi today, is 55.94% with the tenor $112.36 billion TVL. Terra’s the second-largest blockchain TVL in defi on Sunday with $20.17 billion which is 10.04% of the TVL in defi.

The third-largest blockchain TVL in defi is Binance Snappy Chain (BSC) with $12.13 billion locked. Defillama.com metrics show Chainlink is the largest defi oracle today securing 138 codes with $52.66 billion locked.

In terms of smart contract coins, cypherium (CPH) was this week’s biggest gainer with a 330% gain ground. The smart contract coin, in terms of this week’s second-largest gains, is the old-school token counterparty (XCP). Counterparty has pass overed 54% higher in value against the U.S. dollar during the last seven days.

Terra (LUNA) managed to pin by 52% this past week as the coin is the third-largest smart contract token gainer this week. At the every so often of writing, the aggregate value of all the smart contract platform native tokens in existence is $611 billion down 0.3% in the wear day.

Presently, there’s $23.63 billion TVL across cross-chain bridge platforms today up 16.6% since last week. The number of unique bridge deposit addresses during the last month is 57,911 addresses.

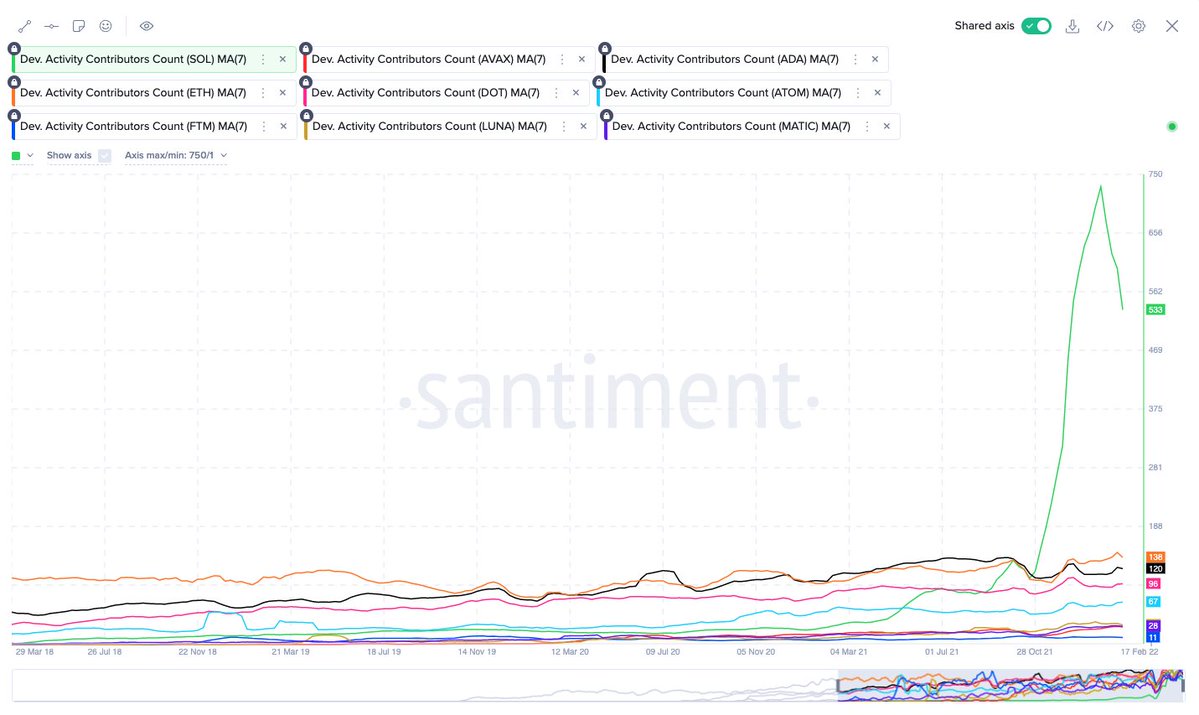

The top five blockchains in terms of cross-chain link TVL on Sunday, February 27 include Avalanche, Polygon, Fantom, Ronin, and Arbitrum. Moreover, data collected by Invent98 Analytics from Santiment indicates that Solana has the most active developer count as of February 19, 2022. Solana’s developer figure on is followed by Ethereum, Cardano, Polkadot, Cosmos, and Terra.

What do you think about this week’s decentralized back action? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coin98 Analytics, Defillama.com, Santiment,

Disclaimer: This article is for informational goods only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not victual investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss precipitated or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer