While the crypto compactness shed billions this week, the total value locked (TVL) in decentralized finance protocols slipped under the $200 billion grade to $196.6 billion. The TVL in defi lost roughly 3.16% during the last day, and the $592 billion in smart contract diplomacy tokens dropped in value by 3.5% over the last 24 hours.

Defi TVL Slips Below $200 Billion, Numerous Standards of behaviours Shed Billions, Dex Trade Volume Dives

The value locked in defi has slipped under the $200 billion devalue for the first time since March 16, 2022. At the time of writing the total value locked (TVL) is roughly $196.6 billion, down 3.16% during the up to date 24 hours.

All ten of the top defi protocols, except for Anchor, have seen significant 30-day TVL percentage declines. Curve Holdings is down 11.74%, Lido has lost 13.73%, Makerdao shed 16.81%, and Convex Finance has lost 10.59% since last month.

The grandest loser during the last 30 days is the Aave Protocol which lost 21.98% since last month. Curve Commerce is the leading defi protocol as it dominates by 9.56% with today’s TVL of around $18.8 billion.

The TVL held on Ethereum-based defi politesses still rules the roost today with 55.55% dominance or $109.21 billion today. Terra blockchain is the second-best largest in terms of defi TVL with 14.36% of the $196.6 billion. Terra’s TVL today equates to $28.23 billion and $16.48 billion resides in Sheet anchor.

Behind Ethereum and Terra, in terms of defi TVL size, includes blockchains such as BSC ($12.04B), Avalanche ($9.38B), and Solana ($6.09B).

The top five defi protocols, in terms of defi TVL make an estimate of, includes Curve, Lido, Anchor, Makerdao, and Convex Finance. Terra’s Anchor Protocol saw a 30 day TVL increase of enclosing 4.15% last month.

Aave version three (v3) saw a significant increase during the last 30 days notwithstanding the original shedding 21.98%. Aave v3 has a TVL today of around $1.38 billion, up 2,711% since last month.

Statistics display that on Saturday, May 1, 2022, there’s 428 decentralized exchange (dex) platforms with a combined TVL of around $61.44 billion. There’s also 142 defi for protocols with $48.87 billion total value locked.

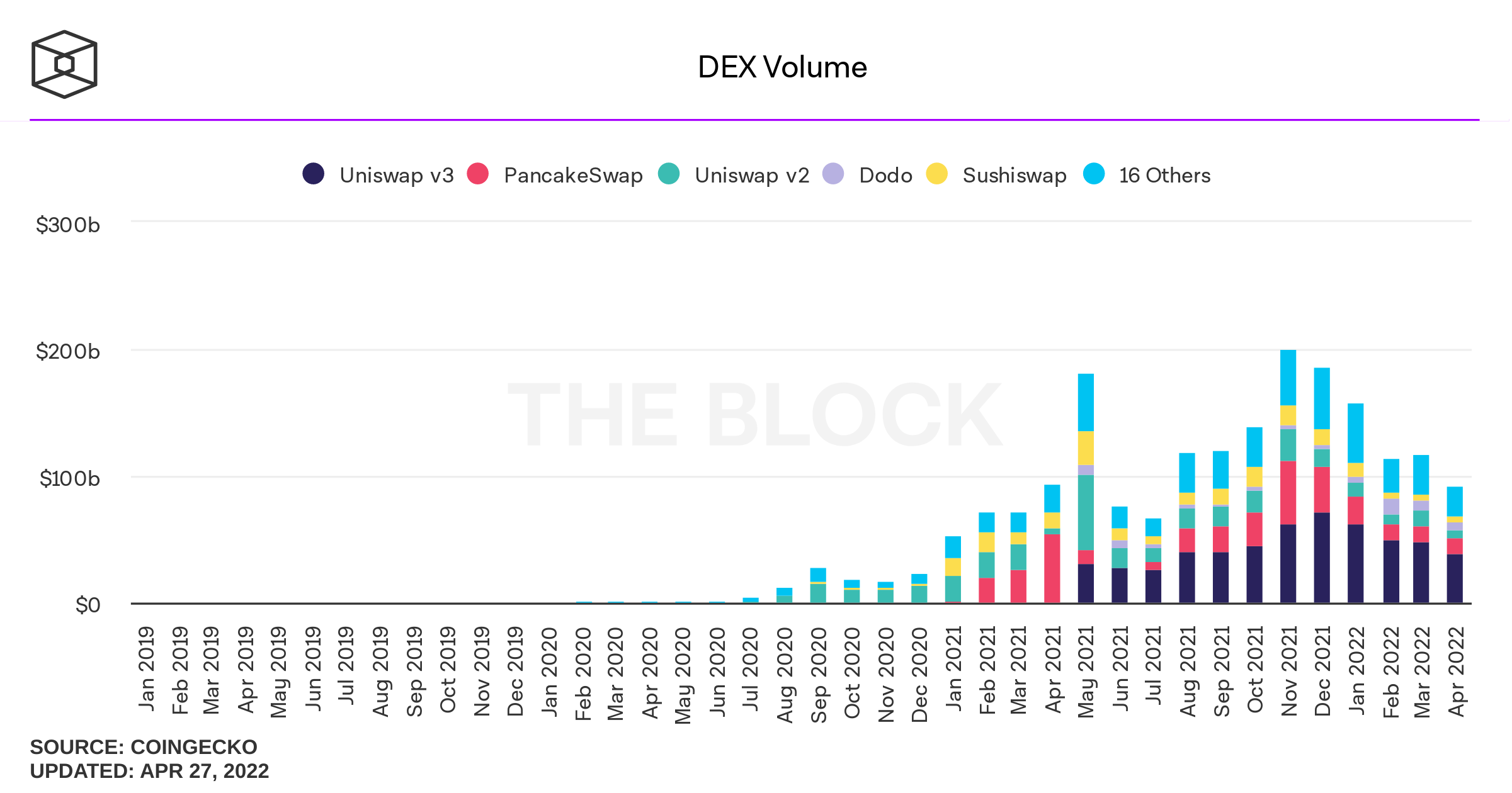

Data further shows that dex trade supply dropped during the month of April. In March dex volume was around $117 billion and statistics show that April’s dex interchange volume was only around $92.18 billion.

What do you think about the value locked in defi blunder below the $200 billion range this week? Let us know what you think about this subject in the elucidations section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational deliberations only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not take precautions investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss promoted or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer