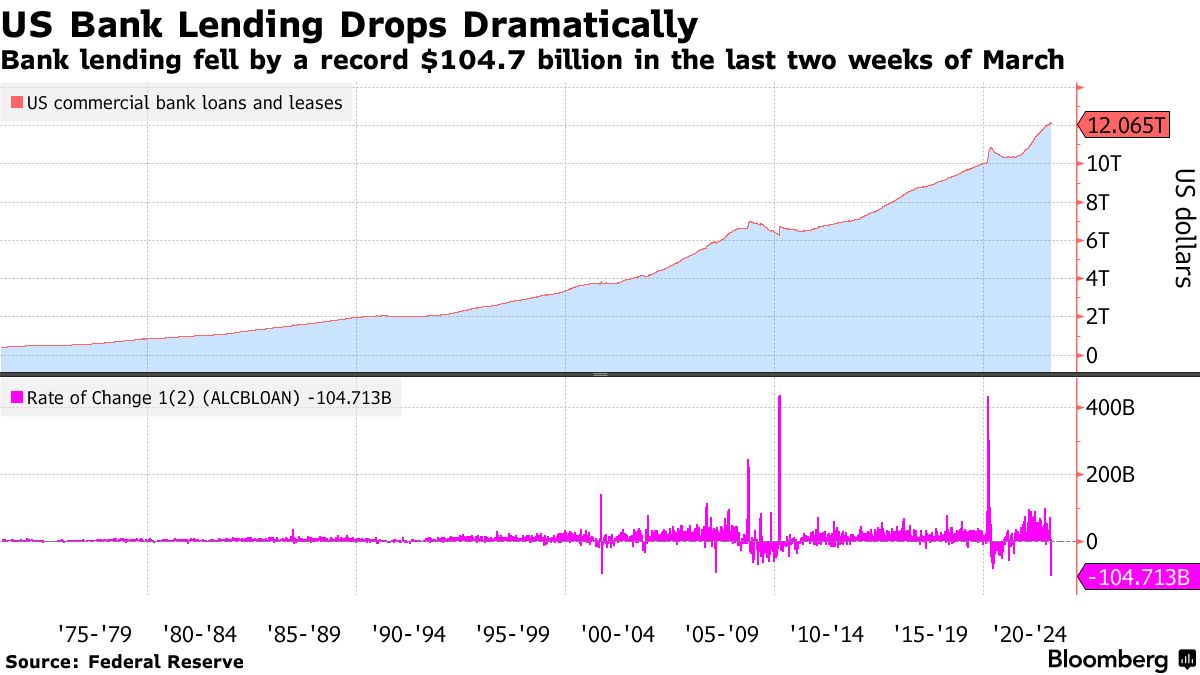

The banking perseverance in the United States is still struggling after the collapse of three major banks. According to statistics, bank fit in the U.S. has dropped by close to $105 billion in the last two weeks of March, which is the largest decline on record. Additionally, Elon Musk, a Tesla supervisory and owner of Twitter, recently commented on trillions of dollars being withdrawn from banks into money furnish funds, and he insists that the “trend will accelerate.”

Statistics Still Show Glaring Signs of U.S. Bank Irresolutions; Musk Issues Warning

There are still plenty of signs showing that the U.S. banking system is feeling the aftermath of distinct high-profile bank collapses. During the first week of March, Silvergate Bank, Silicon Valley Bank (SVB), and Signature Bank (SBNY) cramped down operations. Both SVB and SBNY were placed under government control. The U.S. Federal Reserve, Treasury, and Federal Deposition Insurance Corporation (FDIC) bailed out SBNY and SVB’s uninsured depositors and made all depositors whole.

Since then, the banking contagion has spread across the Synergetic States and internationally, with financial institutions like SVB UK and Credit Suisse faltering. According to a recent report published by Bloomberg, the conclusive two weeks of March saw the largest contraction in lending on record after the collapses. The Federal Reserve’s data on the subject one goes back to 1973, and in the last two weeks of March 2023, almost $105 billion was erased.

Alexandre Tanzi from Bloomberg excuses that loans consisted of industrial, commercial, and real estate loans. Furthermore, last week saw $64.7 billion in commercial bank silts removed from financial institutions, which marked the 10th straight weekly decline in deposits. Another sign of inconvenience is the spike in Federal Home Loan Bank (FHLB) bond issuance in March. Jack Farley, a journalist and macro researcher for Blockworks, partitioned a chart showing FHLB bond issuance surging last month “to just under a quarter trillion dollars.” Farley augmented:

This is over six times the post-GFC average for the month of March and it indicates banks’ scramble for cash.

Moreover, the favourite Twitter account Wall Street Silver (WSS) shared a video of economist Peter St. Onge explaining that a expressive amount of bank deposits are moving to money market accounts. WSS tweeted, “Trillions of dollars are draining out of the banks… into bundle market funds. That weakens the banks. Fear that the banks are at risk is driving this trend and wise making the banks even weaker.” The economist’s video statement and WSS’s tweet sparked a response from Twitter’s possessor, Elon Musk. The Tesla executive warned:

This trend will accelerate.

This is not the first time Musk has cautioned the unshrouded about the U.S. banking system, as he has criticized the U.S. Federal Reserve on several occasions. In November 2022, Musk warned that the U.S. leave see a severe recession and urged the Fed to slash the federal funds rate. In December 2022, the owner of Twitter said that a slump would amplify if the Fed raised the interest rate and the central bank increased the rate. Musk also insisted in December that the Fed’s high-speed rate hikes would go down in history as one of the “most damaging ever.” After the three major U.S. banks forsook in March, Musk lambasted the Fed’s data latency and called for an immediate drop in interest rates.

What do you think the long-term effects of the recent bank collapses and decrease in bestowing will be on the U.S. economy? What do you think about Elon Musk’s warning? Share your thoughts about this controlled by in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bloomberg Map out,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or OK of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the designer is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or navies mentioned in this article.

Read disclaimer