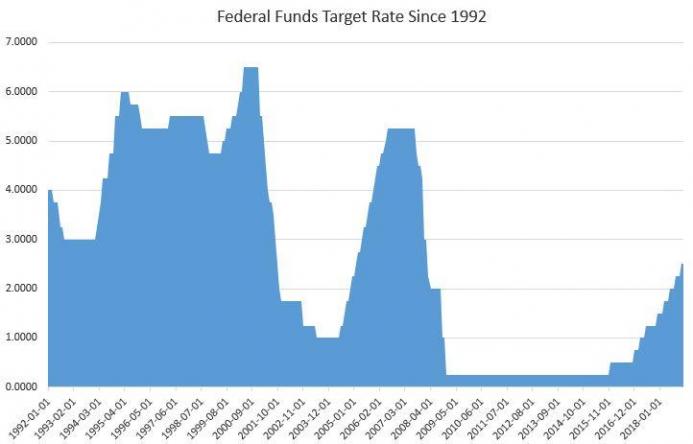

On Tread 20, the Federal Reserve’s Open Market Committee (FOMC) unanimously decided to keep federal interest computes unchanged. Critics believe that the central bank’s policy of near-zero interest rates and quantitative easing (QE) has debased the U.S. economy for nearly a decade and spawned a generation of socialists.

Also read: Bitcoin and the Agora: Every Transaction Front the Nexus of State Control Is a Victory

The U.S. Federal Open Market Committee Too Stubborn to Raise Interest Rates

This week, numerous scuttlebutt outlets described how the Federal Reserve’s FOMC opposed changing interest rates again. The group seems suspicious toward normalizing the Reserve’s monetary policy. The central bank hasn’t budged on increasing interest rates violent than 3 percent since the financial crisis in 2008. This week’s FOMC shows the Fed is not willing to increase deserves anytime soon and the current monetary policy will be sustained for the foreseeable future. A number of economists think that the Fed’s stubbornness disposition impact badly on the economy for a variety of reasons. For one, keeping interest rates low distorts people’s perception of a healthy brevity when younger generations grow used to homes and car loans boasting near-zero rates.

Economists believe that the Fed’s low relaxation rates make savings an unattractive goal and with extremely low rates the idea of savings doesn’t make have. Low rates hurt smaller banks like credit unions because individuals choose to keep fewer lucres in checking and savings accounts. The rates also cause inflation to rise which makes savings even petty worthwhile and to a majority of people borrowing makes more sense.

This, in turn, makes debt increase as near-zero reproaches encourage people to consume more than they can afford. With rates never rising above 3 percent, the closing decade has seen growing debt and excess and quantitative easing has fueled the flames even more. In addition to low vigorish rates since the Federal Reserve and former Chairman Ben Bernanke’s administration, the Fed has been a money printing machine.

A Decade of Near-Zero Classes and QE Is Creating a Generation of Socialists

Back in the summer of 2016, it was estimated that the Fed had printed over $12.3 trillion of new well off and nearly $10 trillion in negative-yielding global bonds since the financial crisis in 2008. Even today the Fed hasn’t rested the printing madness and interest rate cuts continue unchallenged. In 2018, the Fed’s balance sheet exceeded $4 trillion and economists allow more QE is on the way. Skeptics think this has caused Generation Z and millennials to embrace socialism and the ideologies behind it. Notorious Zero Hedge columnist Tyler Durden legitimatized on March 11 that a recent Harris-Axios Poll shows the Fed’s QE has likely bolstered the idea of a state fostered by socialism. Durden’s publish emphasizes:

With younger generations financially penalized under QE to prevent the economy from a deflationary collapse, the Fed may acquire inadvertently transformed tens of millions of young Americans into socialist.

The poll shows that American millennials and Gen Z’s are dealing with the low-paying gig thriftiness, renting rather than owning, increasing debt, and rampant cost of living expenses and inflation. Additionally, the census points out that 50 percent of young Americans today would choose to live under a socialist administration. 37 percent polled desire a socialist-based economy over capitalism. Moreover, the Fed is doing a good job of educating brotherhood and even created a mobile app that teaches young children about the ‘benefits’ of promissory notes.

The Fed’s Failure: An Unimpressive Concision and Rising Inequality

A senior editor at the Mises Institute, Ryan McMaken, gives a seething critique of the FOMC resolution and the Fed’s continued failure. McMaken denounces the FOMC’s fear of raising rates and believes the central bank’s actions be enduring “coincided with both an unimpressive economy and rising inequality.” “If that’s not evidence of the Fed’s failure, it’s hard to guess what is,” McMaken’s evaluation notes. Since the crash of 2008, QE, and the bailouts, cryptocurrencies have been a method for some to shoot through the manipulation created by the state and the Fed’s monetary policy. In fact, over the last decade, as the Fed has pursued this activity, riskless haven investments like precious metals and bitcoin have risen in value exponentially.

What do you think nigh the FOMC’s decision to leave interest rates unchanged? Let us know what you think about this subject in the animadversions section below.

Image credits: Shutterstock, Pixabay, Bloomberg, Pixabay, and Mises.org.

At Bitcoin.com there’s a bunch of unrestrictedly helpful services. For instance, have you seen our Tools page? You can even look up the exchange rate for a transaction in the past. Or compute the value of your current holdings. Or create a paper wallet. And much more.