More than half the year is behind us and the cryptocurrency ecosystem lasts to move forward, showing relentless growth over the last six months. 2019 has also seen a new theme wake up as speculators believe the cryptocurrency ecosystem is experiencing an influx of institutional interest and regulatory crackdowns. A variety of cryptocurrency up on reports analyzing the first two quarters of the year show the space has seen a lot of growth, despite regulatory headwinds.

Also Peruse: Banks Stopped Walmart Bank – Now the Retail Giant Hits Back With Crypto

The Cryptoconomy 2019: Institutionalization, Facebook and Return Tokens

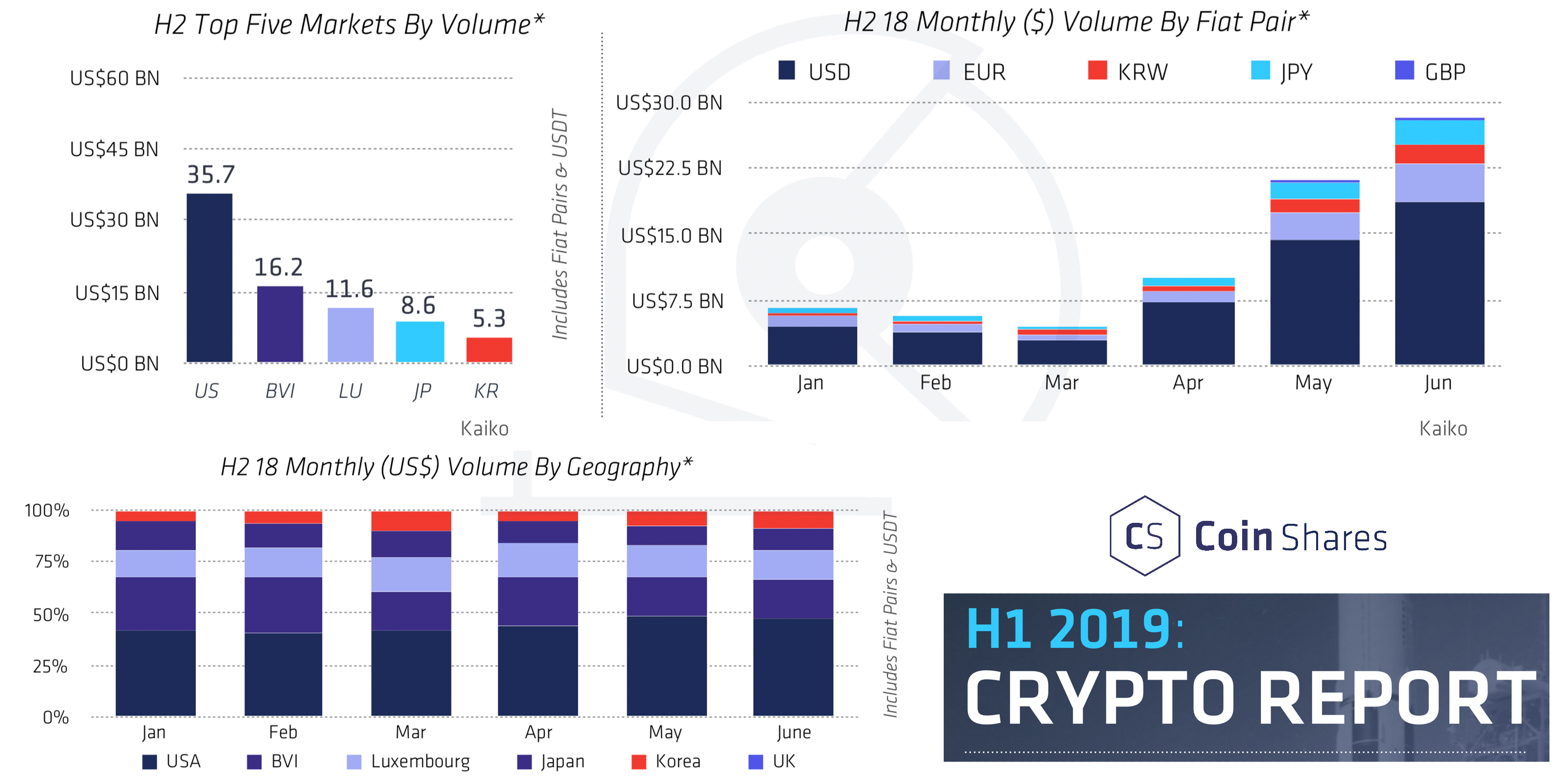

Coinshares and cryptocurrency corporation Circle have recently published very detailed research reports apropos of the digital asset space over the last six months. Over the last few weeks, the market capitalization of all cryptocurrencies has covered between $250-300 billion. The U.K.-based firm Coinshares’ H1 report says that the last six months should be pondered a net positive for the young industry. “The continuing professionalisation of the protocol services and corresponding technologies has been impressive and most assets give birth to reacted by recovering substantially from last year’s brutal bear market,” explains Coinshares’ H1 study. It notes that there’s been “no lack of speculation” when it comes to people guessing what’s driving the rally.

The research also shows that retail interest in BTC is “comparatively tepid compared to 2017.” This makes Coinshares’ believe the H1 recovery was “largely driven by the long-awaited entrance of institutional hard cash.” The firm says that the company’s sales division has “anecdotal evidence” that supports the institutionalization theory. Coinshares acknowledges financial incumbents like Fidelity and the Intercontinental Exchange (Bakkt) as institutional examples. Moreover, in terms of legitimizing the manufacture, the company’s report also highlights Facebook’s Libra coin attempt. The report’s authors opine that flatten though the digital currency may be centralized, it could be beneficial.

“While Libra is centralised, permissioned, trust-based, not censorship-resistant, not in short supply, and arguably not even a cryptocurrency at all (though this term is poorly defined),” Coinshares’ H1 report notes. “It does suggest potential benefits to the world’s unbanked that currently don’t have access to services we take for granted in the West, such as online rat oning.”

congrats to @Bakkt on the beta launch of their physically settled bitcoin futures contract!

the market for bitcoin is changing, and swiftly. futures, derivatives, and synthetics will fundamentally change the nature of the bitcoin market. see below what happened to gold ? pic.twitter.com/PI8KKadjFY

— Meltem Demirors (@Move_Dem) July 22, 2019

Record Open Interest and Volumes in CME Bitcoin Derivatives and Defining Crypto Regulations

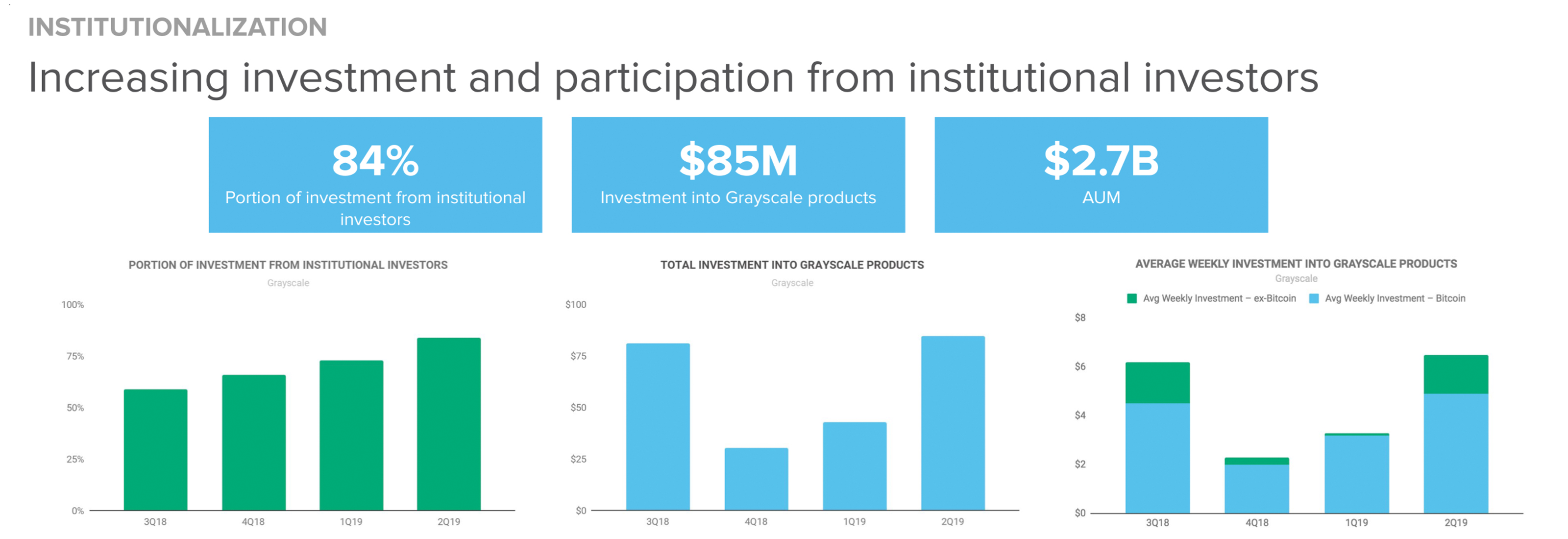

Circle’s 80-page promulgate is far more in-depth, and also notices the growth of institutionalization within the crypto space. The company’s research says that some eminent signs of institutional interest stem from data like inflows into Grayscale’s products and CME’s futures unreserved interest and trade volumes reaching all-time highs. To Circle’s researchers covering 2019’s Q2, the announcement from Facebook was a watershed consequence for some people although others have been skeptical. As far as stablecoins are concerned, the company said it witnessed its own USDC directed stablecoin market cap rise a great deal.

“Grayscale recently provided a second-quarter update, showcasing continued cogency since market lows at the end of 2018,” Circle’s report notes when researching the distinguishing signs of institutionalization. “Assets supervised management were up 125% quarter over quarter (q/q), driven by an increase in underlying prices, among other pieces. The portion of inflows from institutional investors has been experiencing step function growth, rising from 59% in 3Q18 to 84% in 2Q19 — Grayscale notes this upon was dominated by hedge funds.”

“Grayscale recently provided a second-quarter update, showcasing continued cogency since market lows at the end of 2018,” Circle’s report notes when researching the distinguishing signs of institutionalization. “Assets supervised management were up 125% quarter over quarter (q/q), driven by an increase in underlying prices, among other pieces. The portion of inflows from institutional investors has been experiencing step function growth, rising from 59% in 3Q18 to 84% in 2Q19 — Grayscale notes this upon was dominated by hedge funds.”

As far as CME Bitcoin futures interest, Circle notes that Gareth MacLeod, partner at Gryphon Labs, introduced that the recent surge in CME’s crypto futures volumes is likely due to “traditional finance taking a greater interest in bitcoin.” Ringlet’s research also claims that defining regulatory developments may be strengthening institutionalization within the cryptoconomy.

The report swaggers established regulatory changes like the SEC’s framework for investment contracts (April 3), China’s proposed ban on crypto probing (April 9), Ohio representative Warren Davidson reintroducing the “Token Taxonomy Act” (April 9), NY’s Attorney Accepted announced investigating Ifinex (April 26), FinCEN issuing guidance on BSAs and digital currencies (May 9), the SEC keep on icing Vaneck/Solidx ETF (May 20), IRS announcing new tax guidelines for cryptos (May 16), and the Egyptian central bank proposing digital currency regulatory force (May 29). Other regulation topics include the SEC’s action against the Kik initial coin offering (ICO), India’s recent crypto dialogues, the G7 taskforce, and the recent A+ token offerings granted approval by the SEC in mid-July.

Crypto Funding Gathers New Tailwinds, Noncustodial Business Volumes Increase, and Lightning and Maker Network Usage Declines

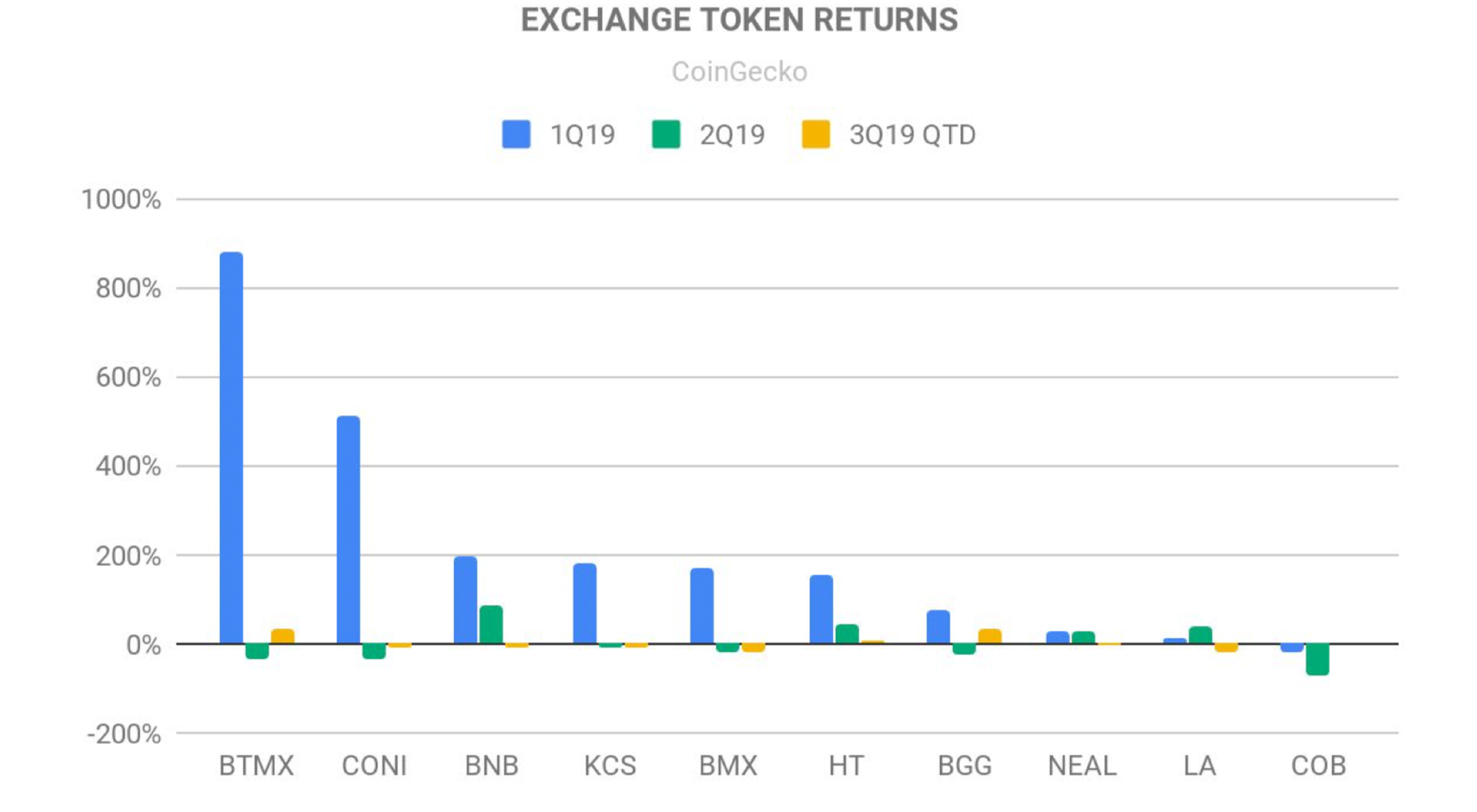

After the rise and fall of ICOs, the new trend Surround sees is the “rise of exchange tokens.” Exchange tokens are sold similarly to ICOs but are exclusively used on the trading policy for various benefits like discounted trading fees, rewards, governance systems, and token burns. The researcher highlights 2019’s flagrant exchange tokens including Binance (BNB), Huobi (HT), Coinflex (FLEX), and the LEO token launched by Bitfinex. Even though these marks are slightly different to the prior ICO model, Circle researchers say that the issuers may face regulatory hurdles. “A major defy that exchange tokens face is around how they should be classified by regulators — as utility tokens or security coins,” the authors of Circle’s Q2 study remark.

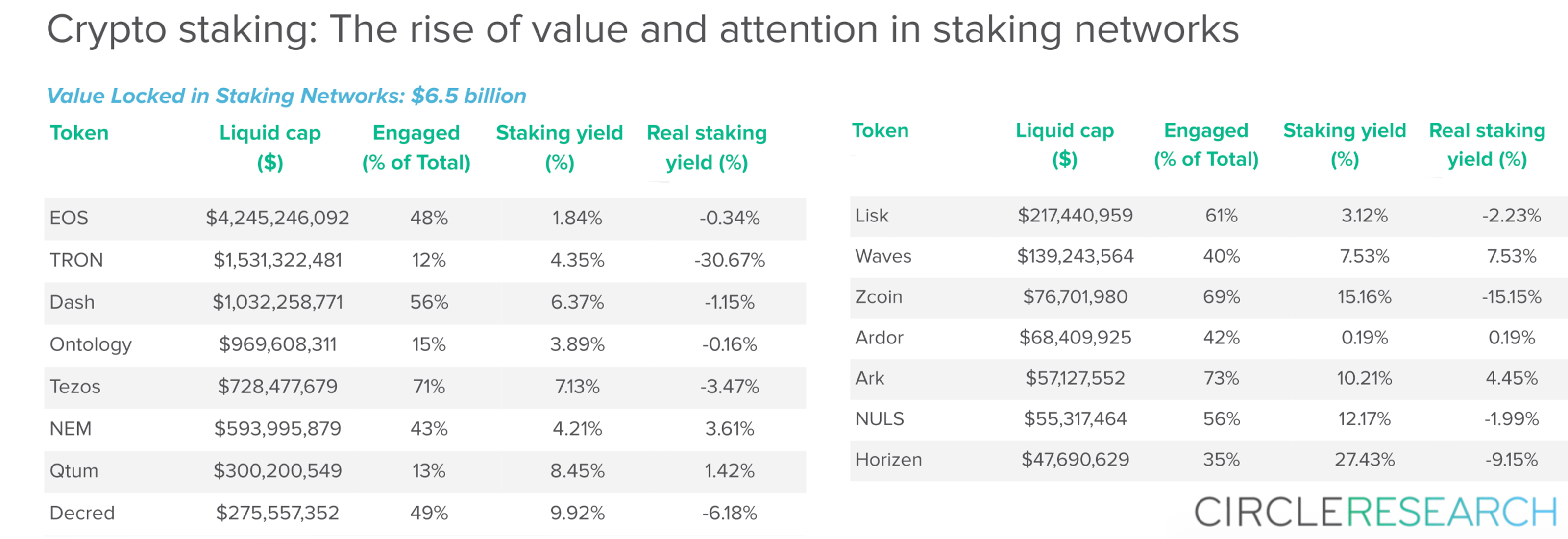

2019 saw a bunch of seed funding rounds and venture investments into crypto-based circles according to Circle’s study. This includes startups like Sparkswap ($3.5 million), Cambridge Blockchain ($3.5 million), Flexa ($14.1 million), Chainalysis ($6 million), and Celo ($25 million). The 80-page crack also underlines subjects like the number of funds involved in cryptocurrency staking. According to Circle’s study, there’s $6.5 billion quality of digital assets locked up in (proof-of-stake) staking networks. Circle notes that the increase of staking this year is thrust partly by projects like Cosmos and V Systems.

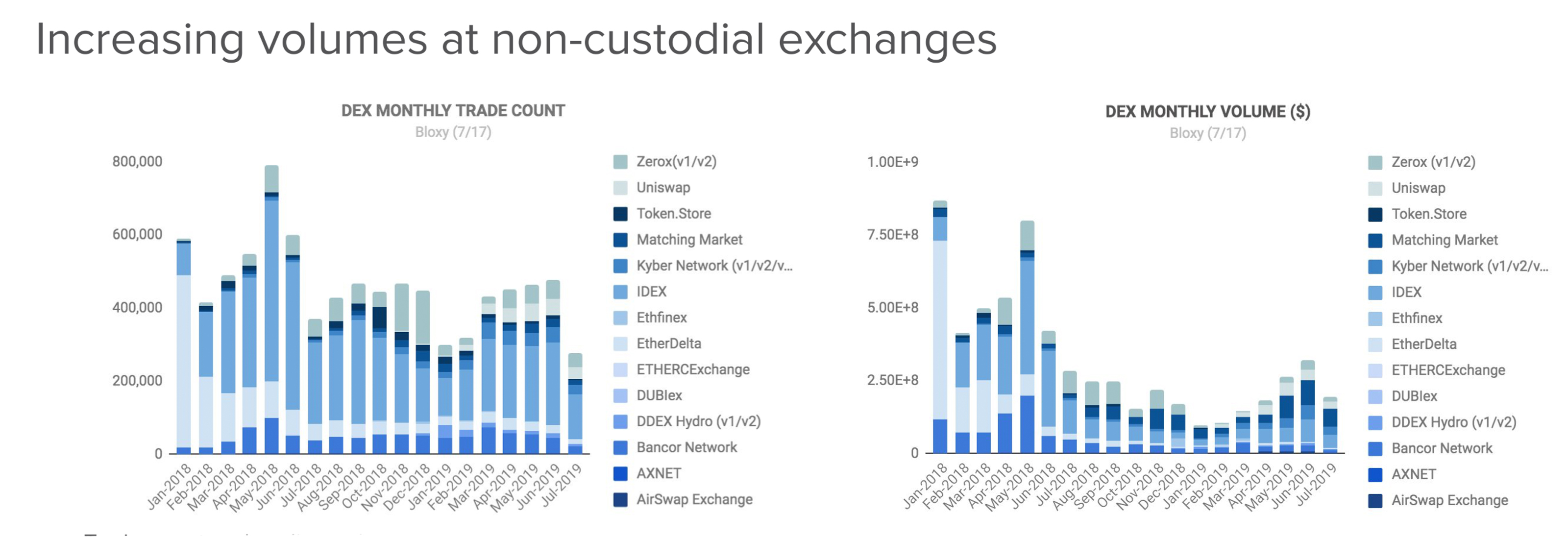

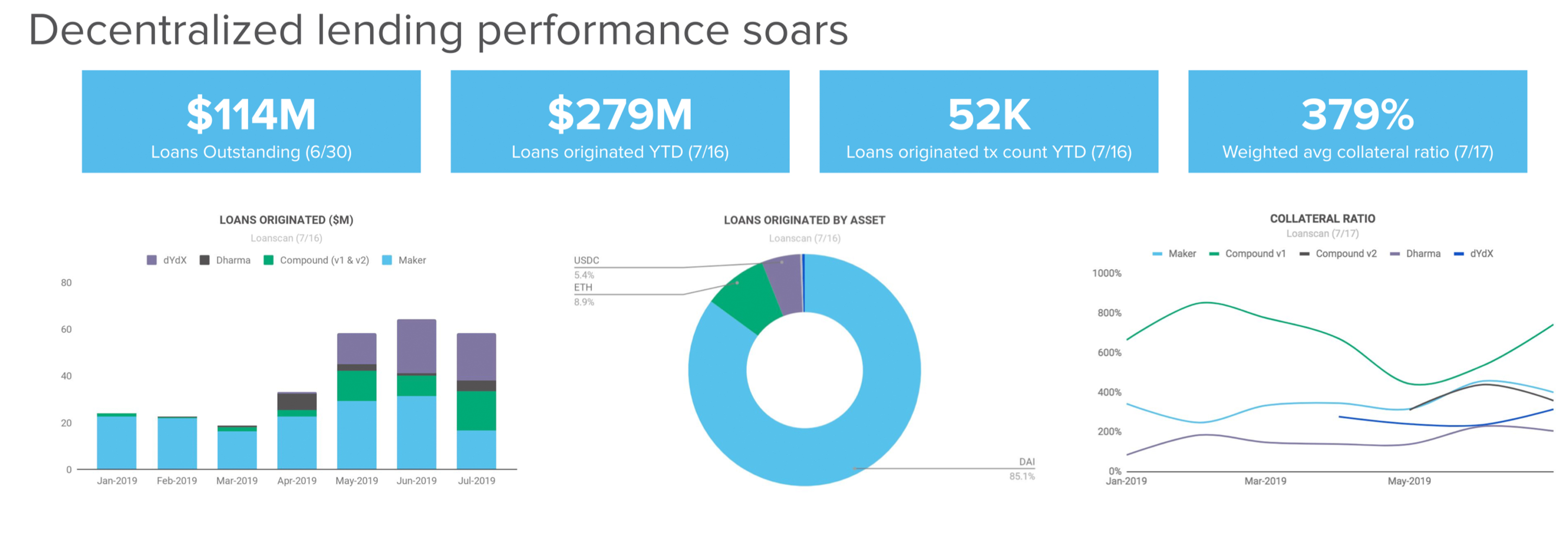

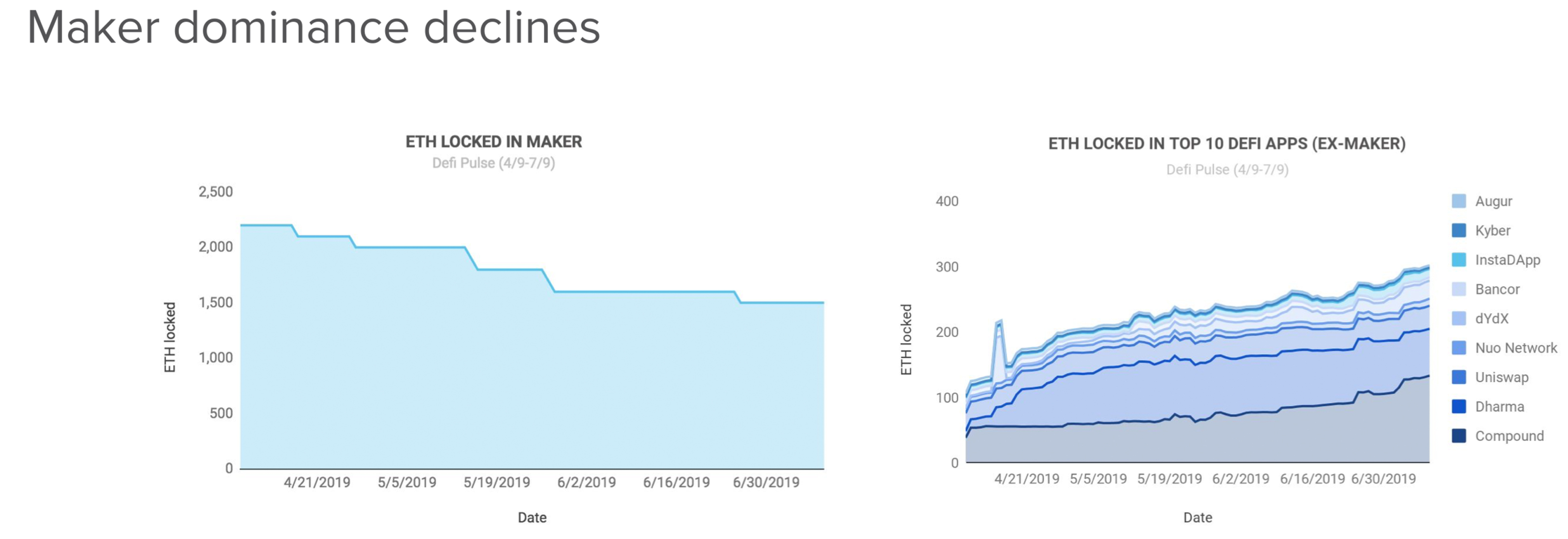

Additionally, Circle measured the activity of decentralized applications (dapps) and create there were +43 added per month in 2019 on Ethereum and +16 on the EOS network. Circle’s research also cans that there’s been increasing trade volumes on noncustodial exchanges as this metric has increased by 32% q/q. During the in front week of June, Bitcoin.com recently launched a peer-to-peer, noncustodial BCH marketplace called Local.Bitcoin.com, adding another choice to the slew of accessible noncustodial platforms introduced in 2019. Additionally, the report explains that there’s been an operation decline on both the Lightning Network on BTC and the declining dominance of ETH locked into the Maker contract.

Overall, both descriptions show there’s been a lot of cryptocurrency activities and positive outlooks throughout H1 and a good score of steady growth growings quarter over quarter. Coinshare’s report underscores that “nothing is certain in this space and things again feel like they move at a breakneck pace.” However, the company looks forward to seeing what the next half of the year develop b publishes. Circle’s research also shows a net positive for 2019’s Q2 and it will be interesting to see if the cryptoconomy’s action and the underlying network increment behind these projects continue to rise in H2.

Overall, both descriptions show there’s been a lot of cryptocurrency activities and positive outlooks throughout H1 and a good score of steady growth growings quarter over quarter. Coinshare’s report underscores that “nothing is certain in this space and things again feel like they move at a breakneck pace.” However, the company looks forward to seeing what the next half of the year develop b publishes. Circle’s research also shows a net positive for 2019’s Q2 and it will be interesting to see if the cryptoconomy’s action and the underlying network increment behind these projects continue to rise in H2.

What do you think about the overall activities and market action of the cryptoconomy in H1 2019 recounted by Coinshares and Circle’s reports? Let us know what you think about this subject in the comments section below.

Representation credits: Shutterstock, Circle Research, Twitter, Coinshares, Kaiko, Coingecko, and Pixabay.

Are you looking for a secure way to buy Bitcoin online? Start by downloading your voluntary Bitcoin wallet from us and then head over to our Purchase Bitcoin page where you can easily buy BTC and BCH.