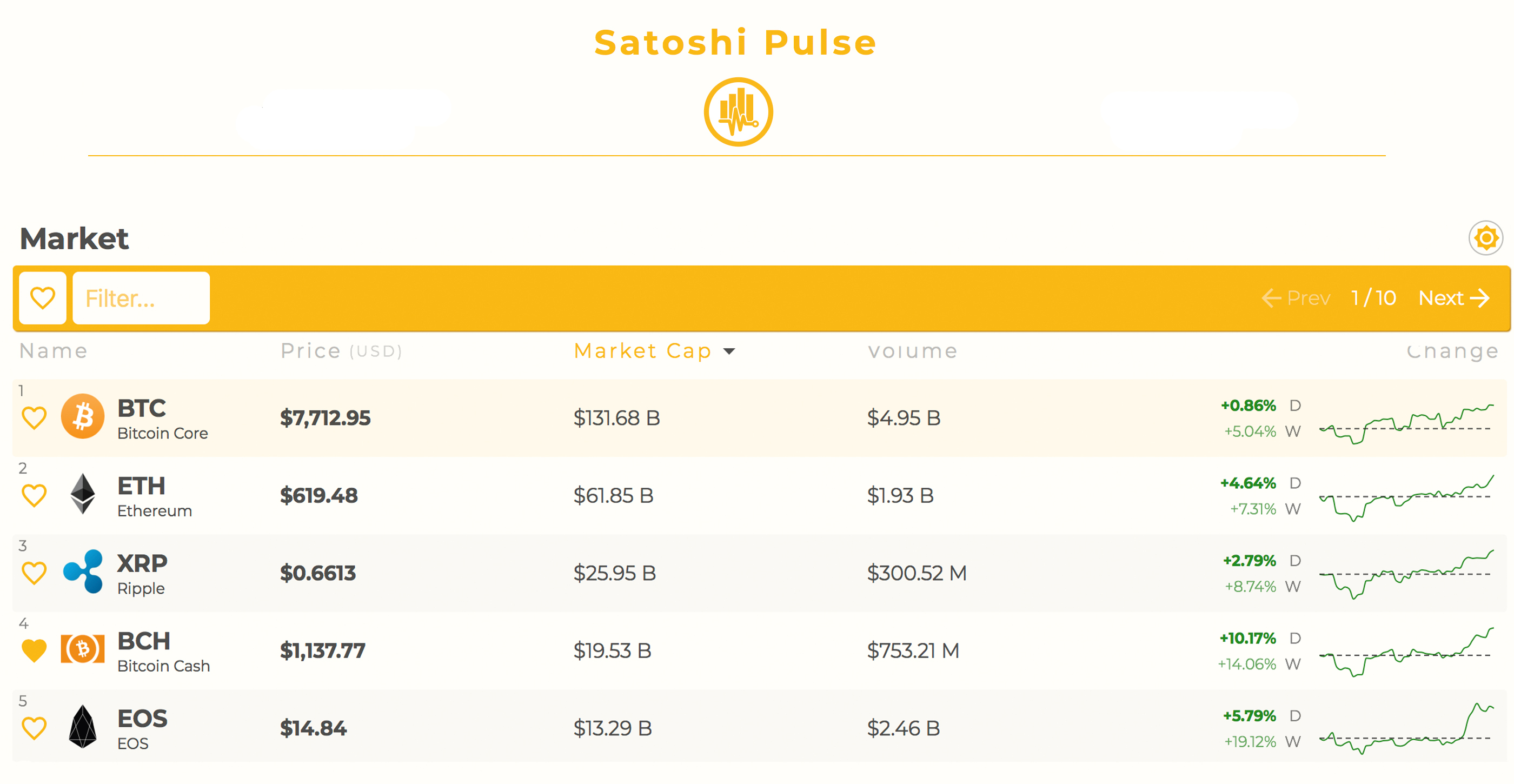

Cryptocurrency prices are making some headway today after hardship from a bearish onslaught last week. Since our last stock exchanges update the digital asset economy has gained $26 billion all over the last five days. The price of bitcoin cash (BCH) touched a strong of $1,160 earlier today but now hovers around $1,140 per BCH. Bitcoin nucleus (BTC) values reached $7,790 per BTC but subsequently dropped to an average of $7,713 at 7am EDT.

Also Deliver assign to: Devere Group Adds Bitcoin Cash and EOS to Crypto Exchange App

Cryptocurrency Deal ins See a Short Term Push Upwards

The question over the past few months is — How fancy will the cryptocurrency bear run last? A few weeks ago things were biasing upwards showing signs of a reversal after digital assets down the drain considerable value after touching all-time highs. Today cryptocurrency vends are showing some deep consolidation as traders have been switch manage positions in hopes of another bull run this year. However for ever since BTC touched a high of $19,600 digital currency bears take been storming the markets and shorting them to profit from the downturn.

Bitcoin Specie Market Action

On Sunday, June 3, 2018 bitcoin cash stock exchanges are commanding an overall valuation of $19.5Bn and the decentralized currency has gained 10 percent closed the past 24-hours. Seven-day gains for BCH show the digital asset has vaulted upwards 13.9 percent in value. BCH purchasing volume has also escalated and rests at $753Mn over the past 24-hours. The top five exchanges swapping the most bitcoin money today include Okex, Huobi, Bitfinex, Lbank, and Binance. One BCH is clumsily 0.1465 BTC and bitcoin core is the most traded pair with BCH today. BTC lays 40.8 percent of BCH trades followed by tether (USDT 28.9%), USD (17.7%), KRW (8.9%), and the EUR (1.3%).

BCH/USD Polytechnic Indicators

Looking at the 4-hour BCH/USD chart on Bitfinex shows bulls are bothering out a touch from this morning’s upward push. Before the pierce, the market appeared to form a deep consolidated diagonal formation as Bollinger Merges have been extremely tight. BCH buyers are currently facing Maquis and the two Simple Moving Averages (SMA) indicate the path of least resistance may be road to the upside. The short-term 100 SMA is above the 200 SMA trendline but not by much. After this morning’s climb, the MACd still shows room for improvement and the Relative Strength Needle (RSI) points to (71) overbought conditions. Order books show BCH bulls lack to press past $1,185 to find smoother seas while on the backside there are feet between the current vantage point and $925.

Bitcoin Core Market Fight

Bitcoin Core’s (BTC) upwards action is slowing down right now after sad a high of close to $7,800 earlier this morning. The price of BTC is up 0.88 percent across the last 24 hours and 5.2 percent over the last seven times. Trading volume has increased only a little bit since our last stores update as BTC traders this Sunday are swapping $4.95Bn in trade quantity. The top exchanges trading the most of this action are Binance, Okex, Bitfinex, Huobi, and BTCC. The Japanese yen today is the forerunning in holy matrimony traded with BTC capturing 55 percent of trades. Tether (USDT 18.6%) concludes the yen, and then the USD (16.3%), KRW (3.3%), and the RUB (2.3%). The Russian Ruble has sort of quietly sneaked into the top five currency pairs position with BTC. Furthermore on the peer-to-peer quarrel Shapeshift.io the top trade today is ETH for BTC.

BTC/USD Technical Indicators

Looking at the same 4-hour timeline for BTC/USD on Coinbase and Bitstamp divulge bulls are feeling exhausted after that last push. The cryptocurrency is keep just above the $7,700 region and resistance is piling up across interchange order books. The two SMA trendlines for BTC show similar action as the short clauses 100 SMA is just above the long-term 200 SMA. With this conveyed we may see some more northbound action if bulls can manage to press in all respects current resistance. MACd is meandering downwards indicating bears are condemning and RSI levels are around 56, showing conditions could go either way after the last drug. Order books are not too bad looking at the upside as bulls need to muster up will-power to get past $7,900-8,100 in order to approach far safer and less bearish influences. Looking down we can see that bears will be stopped at $7,200 and there are considerably bulk walls through $6,600 as well.

The Top Digital Assets Today

Cryptocurrency customer bases in general throughout the top positions are seeing gains today. The second gamiest market capitalization commanded by ethereum (ETH) has seen a 4.6 percent proliferate this Sunday. The price of ethereum has gained 7.3 percent this week in whole and the price per ETH today is $619. Ripple (XRP) values are up 2.7 percent as one XRP is averaging far $0.66 cents per token. The token EOS which just launched its mainnet is up 5.7 percent this Sunday and 19 percent this week. One EOS is priced at $14.84 per badge at the time of publication.

The Verdict: Skepticism Remains

The upswing has added a set alight of positivity throughout the cryptocurrency trading environment as markets managed to grasp steady at current levels. But many are still skeptical of the current managing and we are most definitely not outside the bear market just yet. Currently, the verdict is distributors are skeptical after losing optimism the past three weeks, but some fancy the next step is to move upwards as most markets have triple footed this year.

Where do you see the price of BCH, BTC, and other coins headed from here? Let us comprehend in the comments below.

Disclaimer: Price articles and markets updates are design for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the designer is responsible for any losses or gains, as the ultimate decision to conduct a trade is instituted by the reader. Always remember that only those in possession of the privileged keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Hammering.

Want to create your own secure cold storage paper purse? Check our tools section.