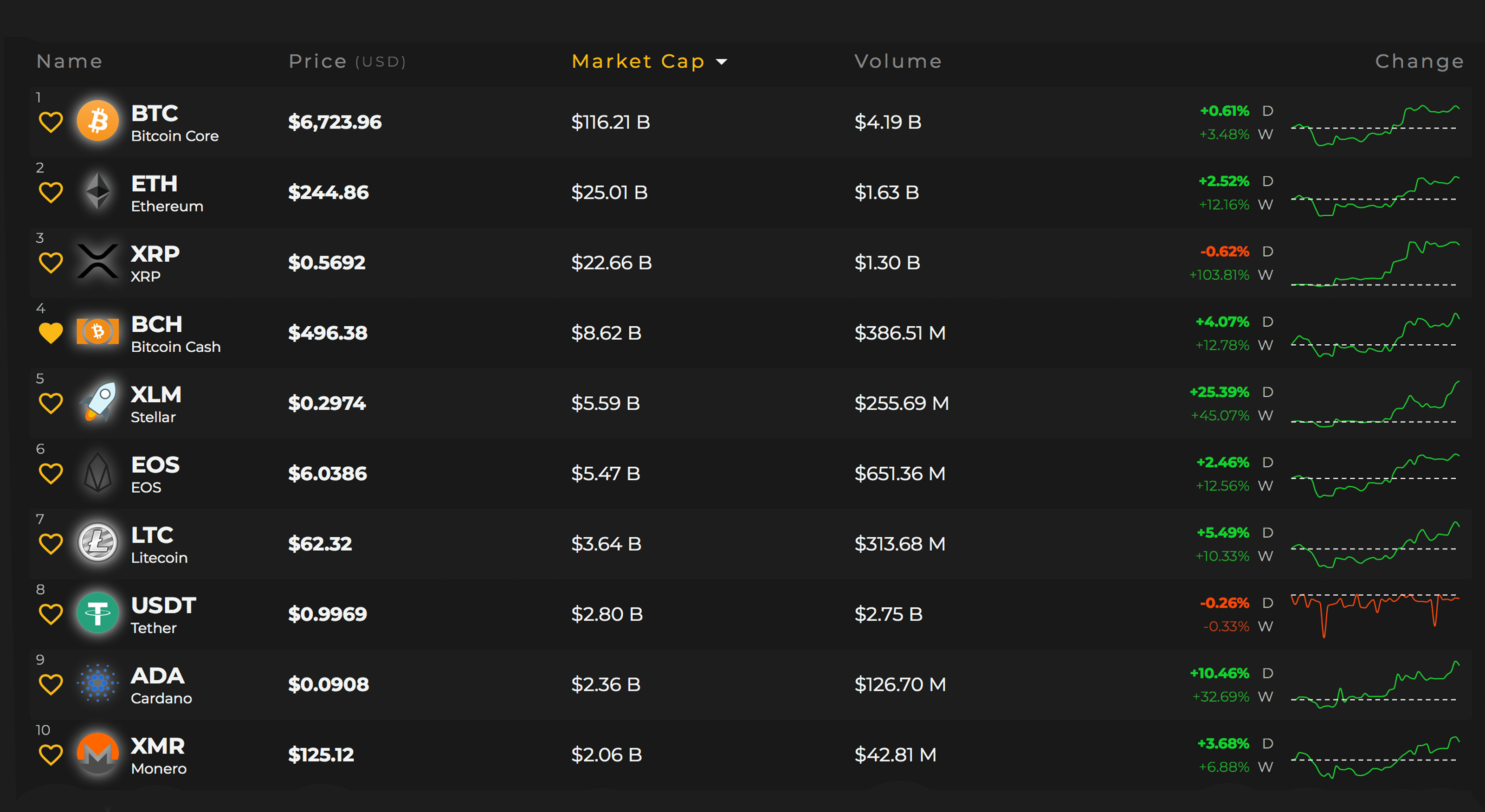

A few days ago digital asset markets saw some good gain grounds pushing the entire crypto-economy up past $229 billion. Both bitcoin gelt (BCH) and bitcoin core (BTC) had nice percentage spikes with BCH up 13 percent, and BTC up 3.5 percent once again the last week. However, the biggest gainer this week was riffle (XRP) jumping over 103 percent over the course of the past seven primes.

Also read: Bitcoin Glyphs Added to Apple’s Shortcuts Attention

Cryptocurrency Markets Rebound and Consolidate

It was a weird week in cryptocurrency come to rest, to say the least. During the last seven days, digital asset champions heard about the Securities Exchange Commission’s (SEC) deciding to hold off on the Vaneck/Cboe ETF settlement until they get further commentary. Then a critical exploit that could participate in caused massive inflation was found in the Core reference client (and multifarious other implementations) by a BCH developer. Lastly, the Japanese exchange Zaif revealed this week it mystified close to 6000 BTC in a hack. Now one would think all of these things would feign cryptocurrency markets in a negative way. On the contrary, digital currency markets spiked in value as a distinguished majority of coins saw seven-day gains.

The Top Crypto-Markets

Bitcoin core (BTC) demands over the last week are up 3.4 percent (US$6,723) and the cryptocurrency’s furnish valuation is around $116.2 billion today. Ethereum (ETH) markets hurriedly up pretty good this week as one ETH ($244) has gained 12 percent. Of speed, the cryptocurrency crowd witnessed the 103 percent increase ripple (XRP) hawks experienced this week. One XRP is valued at $0.56 this Sunday and the enrich oneself’s market capitalization is about $22.5 billion. Bitcoin cash (BCH) calls are up 13 percent per BCH ($492) over the last seven days and the currency’s store valuation is about $8.5 billion this weekend. Lastly, EOS is assayed at $5.45 and the EOS market performance over the last weeks is up 12.2 percent.

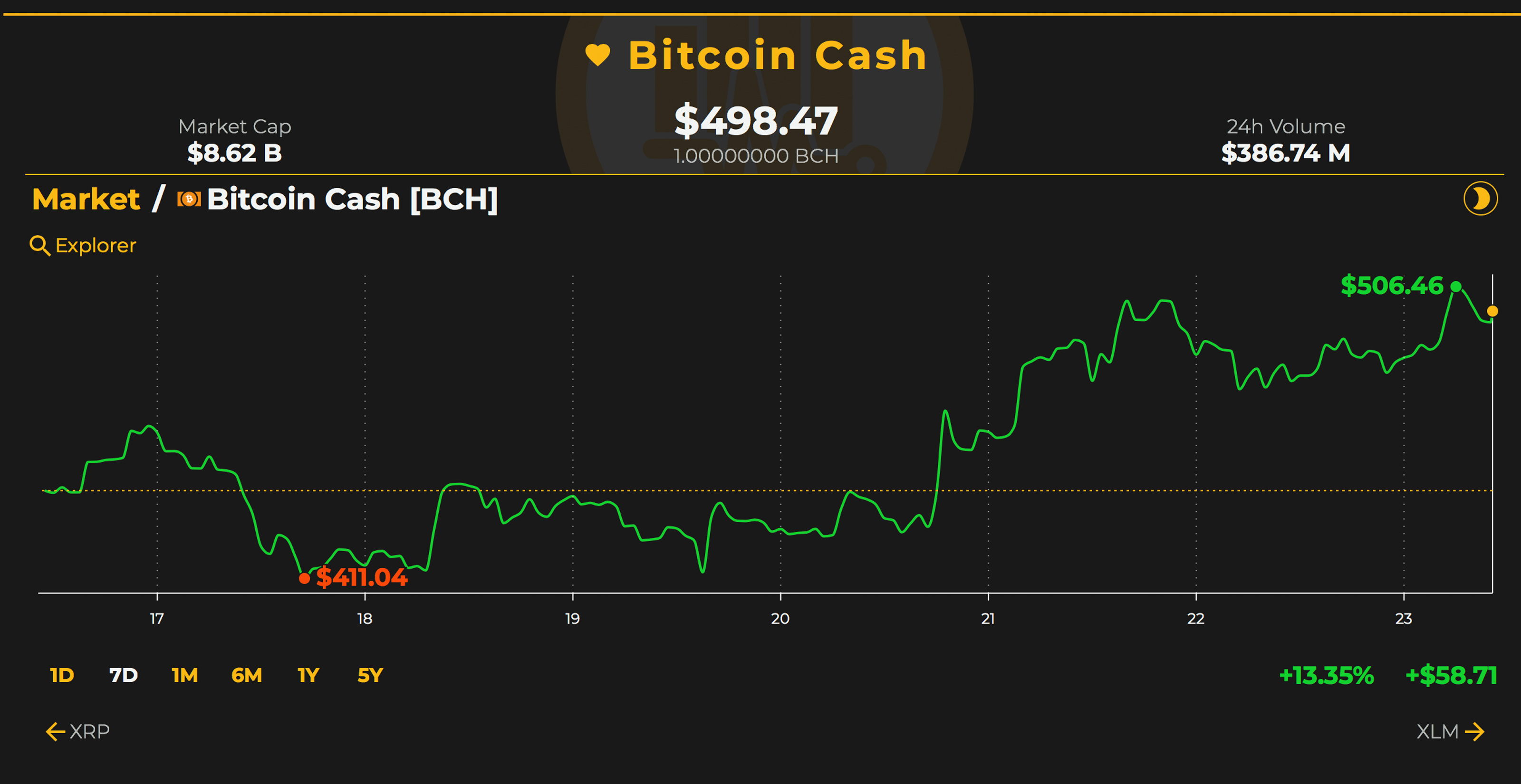

Bitcoin Loot (BCH) Market Action

Bitcoin cash market action today is accompanying the spot price hovering at $492 per coin but this Sunday BCH is up 3.12 percent one more time the past 24 hours. Over the last week, BCH dropped to a low of $411 on September 17 and withed back to a high of $501 on the 21st. The top bitcoin cash swapping exchanges today are EXX, Lbank, Hitbtc, Okex, and Huobi. The top currency unites traded for bitcoin cash this weekend include BTC (51.8%), USDT (30.8%), ETH (6.9%), USD (5.1%), and KRW (2.3%). Bitcoin moolah markets hold the sixth highest trade volumes today lower eos (EOS) and above litecoin (LTC) volumes.

BCH/USD Technical Indicators

The BCH/USD daily and 4-hour charts on Bitfinex and Binance suggest bulls are showing some signs of tiring out. We saw a big spike by the BCH bulls but it hit imposingly resistance as markets gathered near 200 MA and corrected. Today, looking at the BCH/USD 4-hour diagram, the 200 Simple Moving Average is above the 100 SMA trendline make an appearance the path towards the least resistance is towards the downside. The 4-H RSI (61.6) discloses the bulls may be exhausted and we could see some more sell off before another tried upper leg jump. Order books show there’s some melancholy resistance from here until $570 and another pitstop about the $590-630 range. Looking behind us we can see some foundational buttress between now until the $425 range and bears will be stopped there for a high-minded period of time.

BCH/USD daily chart 9/23/18.

BCH/USD daily chart 9/23/18.

The Verdict: Despite Some Setbacks, Shop Confidence Seems to Be on the Rise

Overall market confidence seems to be on the increase despite the recent BTC inflation bug and the SEC’s recent announcement to push off the decision to approve or veer from the Vaneck/Cboe ETF. BTC/USD shorts, however, are very high still with settled 30,000 short positions but ETH/USD short contracts have dropped significantly earlier small after touching their ATH. ETH/USD shorts have been cut from 26,000 on September 17 to just now over 12,000 today.

Charles Hayter, the co-founder and CEO of the cryptocurrency matter website Cryptocompare, believes last week’s ETH drop shook up trade in sentiment. “The fall in ethereum has spooked the market,” Hayter details. How on earth, on a more positive note, Hayter emphasizes “there are multiple commanding financial institutions looking closely at the space.”

Digital asset merchandising volumes have increased as this weekend has seen trade sum total between $13-15 billion USD over the last 48 hours. This weekend’s verdict is far innumerable optimistic than last weekend but it’s likely we will see some louring consolidation and some corrections before the next level up, unless bears regain their pertinacity.

Where do you see the price of BTC, BCH, and other coins headed from here? Let us advised of in the comment section below.

Disclaimer: Price articles and markets updates are resolve for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the maker is responsible for any losses or gains, as the ultimate decision to conduct a trade is generate by the reader. Always remember that only those in possession of the clandestine keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pounding.

Want to create your own secure cold storage paper billfold? Check our tools section.