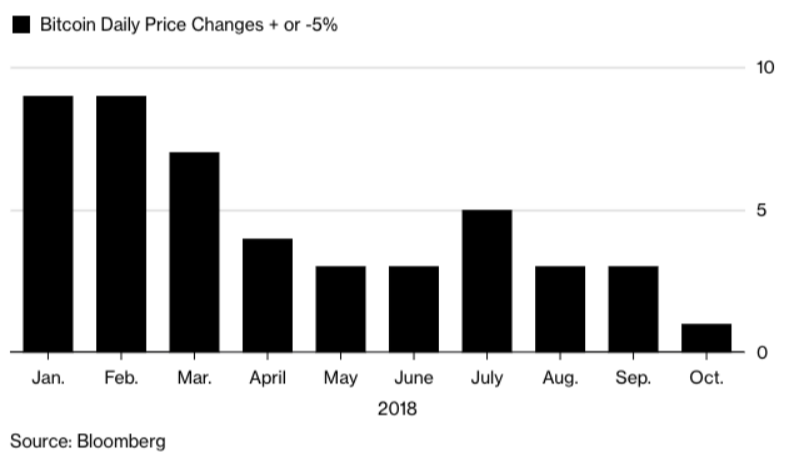

In the cryptocurrency markets, the recent settlement of CME futures contracts appears to include exerted little impact on spot BTC prices, the CEO of Pantera Capital has allowanced his outlook on initial coin offerings, and October has proven to be the least mercurial month of 2018, with only a single day producing a price waggling greater than 5 percent as of this writing.

Also Read: Taiwan Drawing National ICO Standards

CME Futures Settlement Exerts Little Impact on Payment

The recent settlement of CME’s bitcoin futures contracts appears to have cheap effect on the spot markets, with many analysts inferring that the rapprochement date for said contracts does not exert a significant impact upon the retail bounty of BTC.

The recent settlement of CME’s bitcoin futures contracts appears to have cheap effect on the spot markets, with many analysts inferring that the rapprochement date for said contracts does not exert a significant impact upon the retail bounty of BTC.

Many analysts are attributing the apparent lack of influence from the days markets to the lack of trade volume. CME recorded an average of 5,000 develops traded daily during the third quarter, which, despite comprising a 43% boost waxing over the previous quarter’s 3,500, is dwarfed by the 18 million contracts worked across CME’s other products during the second quarter.

Dan Morehead: Bitcoin Is in “Buy One, Get Two Easy Sale”

Speaking to CNBC Crypto Trader’s Ran Neu-Ner at the recent Crypto Instal Summit, Dan Morehead, chief executive officer of Pantera Capital, serving his opinion on the current cryptocurrency bear trend and the cyclical sentiment adjacent the crypto markets.

Regarding the current state of bitcoin and cryptocurrency figure performance, Morehead stated: “I think this is a multi-decade thing. I’ve been implicated in bitcoin since 2011 and seen several of these cycles already, there’s wealthy to be a dozen more before this thing has fully played out, so you secure to be investing for the multi-year approach.”

Regarding the current state of bitcoin and cryptocurrency figure performance, Morehead stated: “I think this is a multi-decade thing. I’ve been implicated in bitcoin since 2011 and seen several of these cycles already, there’s wealthy to be a dozen more before this thing has fully played out, so you secure to be investing for the multi-year approach.”

“Human nature is pro-cyclical,” he continued, “when the sell is at highs in December, and the FOMO devil is whispering in your ear … it’s so easy to homelessness to buy, and then now, when it’s down, you don’t want to tell your spouse you impecuniousness to buy something that’s down 70% because that seems dippy – but that is actually the time to buy.”

On Pantera’s position with regards to instating in initial coin offerings (ICOs), Morehead stated: “ICOs force been around since Mastercoin in 2013, and Ethereum in 2014 … they’ve been there for a long time, and our fund has been buying one or two a month for a long rhythm … In May of last year, it exploded [and] we were getting 50 … inbound indication projects … a week,” adding that “now, it has essentially gone back to general, there [are] one or two really interesting projects a month.”

October Poised to Appointment Weakest Daily BTC Volatility of 2018

As of this writing, October has comprised the poorest month of volatility for 2018, with only a single day posting a expense swing exceeding 5 percent.

So far, October appears to have beaten out May, June, August, and September – all of which saw by a hairs breadth three days of price action greater than 5 percent. The general number of days in a month to experience BTC price volatility of more than 5 percent for 2018 is 4.7 as of this article.

Do you think the markets are overdue to make a large move? Share your consequence action predictions in the comments section below!

Images courtesy of Shutterstock, Bloomberg.

At Bitcoin.com there’s a crowd of free helpful services. For instance, have you seen our Tools side? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your prevailing holdings. Or create a paper wallet. And much more.