The sad hitters in traditional finance have been concerned about the recent stock market action fueled by Redditors and a giant number of retail investors. This week a Goldman Sachs executive warned that if these short crushes continue it could “snowball through the market.” Moreover, Interactive Brokers founder Thomas Peterffy made alike resemble comments this week saying these types of systemic risk can “take down the entire system, theoretically.”

Wallstreetbets Incline Could ‘Snowball Through the Market’

2021 has been an interesting year so far and this week a Reddit forum called r/wallstreetbets specked a whole new hot topic. Four days ago, news.Bitcoin.com reported on the stock market fiasco that started with knee-pants squeezing Gamestop (GME) shares. But GME shares were not the only stocks that felt the push as the wallstreetbets (WSB) trend started discharging into a number of other types of shares.

For instance, stocks from the Russell 3000 Index (RUA) were targeted cataloguing tickers like NOK, GOGO, AMCX, and FIZZ. The social media craze even leaked into the cryptocurrency period pushing up coins like dogecoin and XRP as well. Estimates assume that short-sellers have lost “$70.87 billion from their vest-pocket positions,” according to statistics from the financial data analytics firm Ortex.

An analysis from Zerohedge rats that Melvin Capital lost a whopping $7 billion during the month of 2021. “Melvin Capital spent 53% in January, as Gabe Plotkin (a former SAC Portfolio Manager), lost over $5.3 billion in one month,” the record noted.

The financial newsdesk has also been reporting on another WSB trend taking place during the last week as failing squeezers want to squeeze the silver market. One thread on r/wallstreetbets suggested that the power of the masses could clutch the price of silver from $25 to $1,000. Zerohedge has been reporting on trends that show Redditors and popular media users have managed to invoke demand for silver.

“In the 24 hours proceeding Friday market familiar, SD Bullion sold nearly 10x the number of silver ounces that we normally would sell in an entire weekend supreme to Sunday market open,” the finance reporter disclosed. “In a normal market, we normally can find at least one supplier/provenance willing to sell some ounces over the weekend if we exceed our long position (the number of ounces we predict we resolve sell over the weekend).”

Additionally, polygon.com contributor Owen S. Good reported this week on how the meme-driven provide’ rally rescued AMC theaters from $600 million in debt. Meme lords and Redditors saved this trade, not the U.S. federal government, not the bankers. Those groups were actively shorting AMC down the toilet. “Theater chain engages unexpected lifeline when private equity trades a corporate IOU for stock,” the author’s report explains.

r/wallstreetbets is now the fattest hedge fund in the world.

Excepts it’s completely decentralized and entirely democratic.

— Chamath Palihapitiya (@chamath) January 30, 2021

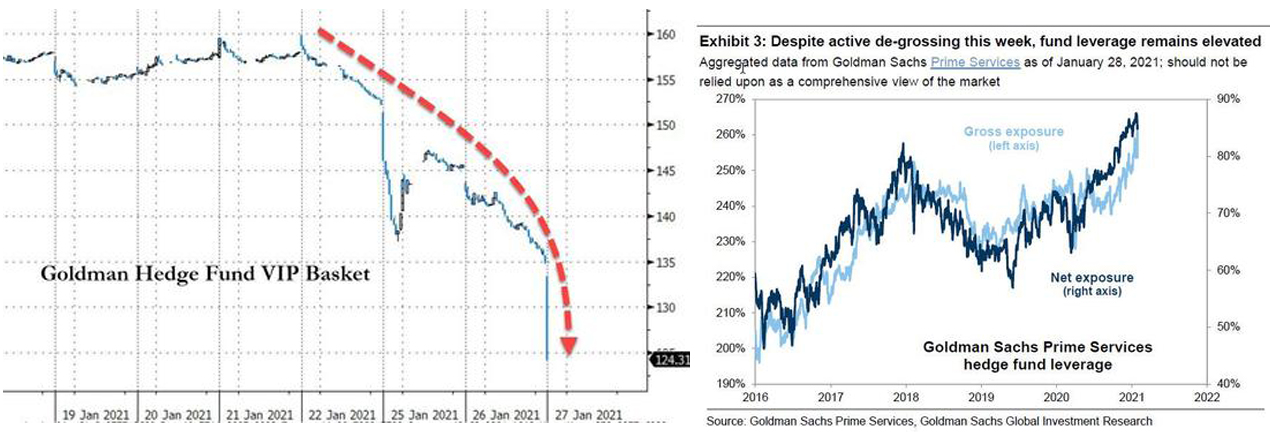

Furthermore, the iniquitous Tyler Durden from Zerohedge wrote about an investors report published by Goldman Sachs executive David Kostin. Durden notations that the latest Goldman report warns “if the short squeeze continues, the entire market could crash.”

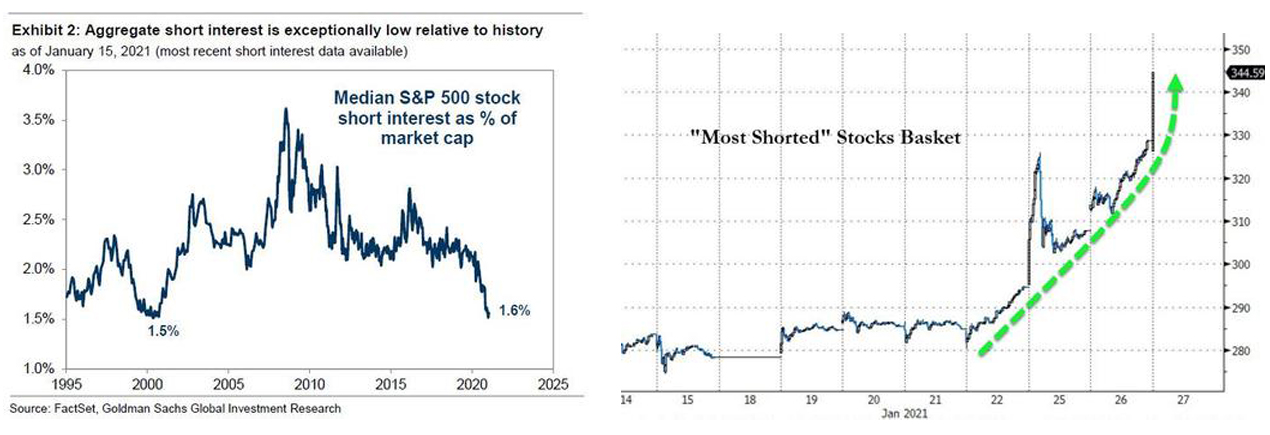

“The most heavily-shorted stereotypes have risen by 98% in the past three months, outstripping major short squeezes in 2000 and 2009,” Kostin’s reflect on details. “This week demonstrated that unsustainable excess in one small part of the market has the potential to tip a row of dominoes and manufacture broader turmoil,” the Goldman analyst added.

According to Durden from Zerohedge, Goldman’s Hedge Fund VIP tabulate declined by 4% this week during the WSB fiasco. “In recent years elevated crowding, low turnover, and high concentration oblige been consistent patterns, boosting the risk that one fund’s unwind could snowball through the market,” Goldman’s David Kostin concluded. Durden understood Kostin’s final conclusion in a different way.

The author writes:

Translation: if WSB continues to push the most shorted stocks higher, the continuous market could crash.

Interactive Brokers Chairman: ‘It Can Take Down the Entire System, Theoretically’

Goldman Sachs executives are not the single financial heavyweights weighing in on the stock market craziness and the possible aftermath. The founder and chairman of Interactive Brokers Heap Inc., Thomas Peterffy, discussed his thoughts about the stock market madness in an interview with Marketwatch financial novelist Mark DeCambre.

On Thursday, DeCambre said that Peterffy delineated that the short squeeze action could go on for a very long time unless it was stopped. DeCambre also wrote that Peterffy was anguished about systemic risk and “the potential” for this trend “to ripple throughout the market.”

“It can take down the entire practice, theoretically,” Peterffy stressed in his interview with DeCambre. “There is no reason why a short squeeze cannot go on indefinitely,” the Interactive Middlemen founder detailed.

i’ll be on @business at 4:20 pm ET to talk memestocks, gamestonk, robinhood, bitcoin, dogecoin, papa musk, and where we go from here

should be a 🌶️well-seasoned🌶️ one

the revolution *will* be televised

— Meltem Demirors (@Melt_Dem) January 29, 2021

Meanwhile, a number of cryptocurrency enthusiasts have been cheering the WSB mode on as the virality of WSB vs Wall Street has encapsulated nearly all the social media conversations in the U.S. Meltem Demirors, the CSO of Coinshares, Europe’s portliest digital asset manager with $3 billion in assets under management (AUM), gave her interpretation of the recent heritage market events rattling the status quo.

“At its core, the events of this week are about free speech, censorship, and power. We are witnessing the fastest roll-up of power in benign history,” Demirors said.

“As our lives become increasingly dependent on digital mediums,” Demirors continued. “So does the knack of powerful entities like governments and corporations to censor our right to free speech, our right to gather, our right to qualm, and more. There is an unprecedented amount of power up for grabs, and what we see is a battle for control. It already played out on the political rostrum show business, and is now playing out in financial markets, financial media, Fintech platforms, and social media,” the Coinshares CSO added.

Furthermore, on January 29, the cryptocurrency patronage platform Bittrex Global revealed that it was listing tokenized stocks for a number of the shares the WSB trend has been counterfeit. The exchange detailed that it made the decision because Bittrex wanted to “ensure retail investors have jeopardy to stocks they may wish to trade anytime during any day of the week.”

The crypto exchange also plans to list any other mainstream haves that other finance trading platforms may censor in the future. The newly listed tokenized shares on Bittrex Epidemic include Gamestop (GME), AMC Entertainment (AMC), Blackberry (BB), Nokia Corporation (NOK), and the Ishares Silver Trust (SLV). However, U.S. residents cannot participate, as Bittrex International geo-blocks American citizens visiting the web portal.

“Bittrex is regulated in Lichtenstein and Bermuda and thus U.S. investors may be blocked from profession in these securities but other jurisdictions may be able to trade in these securities if they are interested,” the company details.

What do you over about the recent wallstreetbets (WSB) trend and Goldman and Interactive Brokers executives warning of systemic risk to the traditional cash system? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Ordinaries, Tyler Durden Zerohedge, Goldman Sachs Global Investment Research, Twitter, r/wallstreetbets,

Disclaimer: This article is for informational have in minds only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not outfit investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss induced or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer