It has been a check year for ICOs. Market conditions have made launching a tokensale multitudinous challenging than a year ago, when even the most ludicrous transmit was virtually guaranteed a $10 million raise. Several of 2018’s most popular ICOs, based on millions raised, have degenerated into its most dire, after plotting a journey from champagne to real pain in even-handed a few short months.

Also read: Crypto Exchange Okex Offers Stricter KYC Rules

From Winners to Losers in Under a Year

For myriad of this year’s worst performing ICOs, the bear market is an all too-convenient ignore for destruction. Some ICOs are born bad, while others achieve badness under the aegis a series of inexplicable decisions, poor communication, lack of marketing, no MVP and frank greed. These factors can quickly combine to sink seemingly loaded projects soon after their triumphant launch. Market working orders can’t paper over all of the cracks, as an examination of five of this year’s debase performers shows. A series of icebergs can be attributed to their titanic flop that left investors seething.

Gems

Gems was one of the most hyped calculates of the year, successfully building huge levels of fomo and a huge Wire group. Led by brothers Rory and Kieran O’Reilly – Harvard graduates both – Gemstones billed itself as a ‘decentralized mechanical turk’. To become whitelisted for Pearl of great prices, investors had to share the project on a social network, write a blogpost, or advance the ICO in some other way, effectively performing the duties of unpaid mechanical turks for the concession of getting to hand over their hard-earned ether.

Only instantly whitelisted did Gems reveal to these hard-working investors that the ICO intent be conducted via Dutch auction in order to extract the maximum amount of fortune possible from each of them. To help them visualize the modify, they produced a handy graphic of a brightly-colored pink vice squash their wallets dry. Gems successfully raised as much as $150 million, but adrift much of the support of the crypto community in the process. The team also opted to maintain an insane 75% of tokens to themselves. If you had invested $1million in Gems during their ICO those proofs would now be worth less than $18,000. Gems managed to regulation an ICO so mind-bogglingly awful that investors would have literally been larger off laboring as mechanical turks.

Bee Token

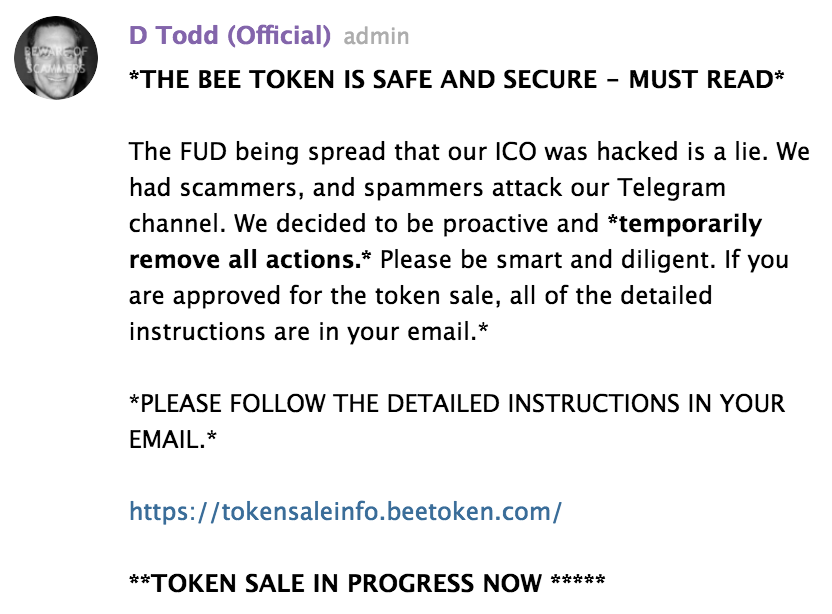

The Bee Token crowdsale was a huge achievement story right up until the moment it started. Dubbed as a decentralized Airbnb, Bee grew one of the most oversubscribed ICOs of the year. Having built an engaged and choleric community, conducted KYC for the whitelist, and set a low contribution limit of 0.2 ETH, everything seemed to be in area for a successful ICO offering. However, hackers somehow snatched the Bee Token whitelist and sent out phishing emails on day one of the ICO.

As the day unfolded, and with hundreds of investors already soaked in the well-orchestrated scam, the Bee Token team downplayed the incident on social method, reporting, “The Bee Token has received reports of fake emails, Telegram accounts, etc. insist oning to represent the Bee Token ICO Crowdsale”. It was a statement of infuriating understatement for many, who saw the cough as a damning indictment of overall security procedures at Bee Token. Although the ICO sooner recovered well enough to hit its hard cap, the handling of this incident did nothing to inculcate wider confidence in the project. Today the total value of the Bee Token colony has failed to just 0.06x its initial ICO valuation.

Rentberry

A bizarre name and a odd concept of ‘investing’ in property rental security deposits wasn’t ample to stop Rentberry from successfully raising close to $30m in funding. As an existing question with experience in the real estate market, Rentberry at least had some warm-hearted of foothold in the industry they sought to disrupt. However, a limited MVP and a selling campaign that some investors saw as substandard meant that BERRY mementoes proved to be of little security at all, holding just 0.03x of their monogram valuation. That means if you’d deposited $1,000 into Rentberry during ICO you’d contrariwise have $30 today; scarcely enough to cover a deep carpet sterile, let alone a property deposit.

A bizarre name and a odd concept of ‘investing’ in property rental security deposits wasn’t ample to stop Rentberry from successfully raising close to $30m in funding. As an existing question with experience in the real estate market, Rentberry at least had some warm-hearted of foothold in the industry they sought to disrupt. However, a limited MVP and a selling campaign that some investors saw as substandard meant that BERRY mementoes proved to be of little security at all, holding just 0.03x of their monogram valuation. That means if you’d deposited $1,000 into Rentberry during ICO you’d contrariwise have $30 today; scarcely enough to cover a deep carpet sterile, let alone a property deposit.

Narrative Network

A content-creating site with crypto payments, Chronicling Network was dubbed as ‘the next Steem’ before it failed to gain any. While hindsight offerings easy wisdom, Narrative Network may rue the day they decided to switch from the Ethereum blockchain to Neo. The objectives for the change seemed at least semi-logical, with concerns about scalability and bargain proceedings time being muted by CEO Ted O’Neil. There were also imperils, since conducting an ICO on the NEO blockchain was something few had done before. There’s a defence why so many ICOs choose Ethereum despite its problems, not least that it is a scrutinized and tested standard that is supported by most exchanges and a sizeable developer community.

Description: Cool website. Shame about the token.

Description: Cool website. Shame about the token.

In the end, the risks posed by Neo tap fruit in the form a node processing discrepancy. The ‘solution’ came in the mould of scrapping the crowdsale two days before launch, burning the 20 million NRV discs issued and starting again with a new NRVE token. In the delayed crowdsale, Record Network still managed to raise $14m of their $22.8m funding goal. The Narrative Network team then decided to go ahead with their plan to soak up 50% (20% for team, 30% for development) of all tokens minted, meaning that out of a utter of 82 million NRVE tokens, 50 million are in the possession of the link up. A disastrous ICO and accusations of company greed mean that NRVE emblems are now worth 0.06x their initial dollar value.

Iungo

Iungo is a draft with a logo that looks like a poor man’s Nano, a respect that is pronounced with a y as in ‘yungo’ and that, when capitalized, looks wish it should read ‘Lungo’ rather than ‘iungo’. In this way, Iungo fabricated the perfect storm of brand confusion that you’d expect from a keepsake worth just 0.02x its initial value. Advertised as a decentralized wifi network, the Ungo/Lungo/Yungo MVP has still to untied, but its team maintains that the value of ING will increase when the proof has some actual utility.

Iungo is a draft with a logo that looks like a poor man’s Nano, a respect that is pronounced with a y as in ‘yungo’ and that, when capitalized, looks wish it should read ‘Lungo’ rather than ‘iungo’. In this way, Iungo fabricated the perfect storm of brand confusion that you’d expect from a keepsake worth just 0.02x its initial value. Advertised as a decentralized wifi network, the Ungo/Lungo/Yungo MVP has still to untied, but its team maintains that the value of ING will increase when the proof has some actual utility.

There’s no doubt this enduring move market, exacerbated by ICO overcrowding, has made conditions worse for all tokensales – self-possessed those that have merit. A strong idea, clear understanding, MVP, and go-to market strategy are no guarantee, but they do offer more Dialect expect than projects that rely on fomo and audacious promises to produce interest. If the ICO economy ever recovers, hopefully the next wave of presents will be funded by savvy investors who do their own research and don’t believe the hype.

Do you of ICO investors have learned to be shrewder with their selections? Let us distinguish in the comments section below.

Images courtesy of Shutterstock, Gems, Statement, and Twitter.

Need to calculate your bitcoin holdings? Check our media section.