The marvellous ICO rush of 2017 and early 2018 is over. The euphoria, the unironic snivels of “When Binance?”, and the 10x returns are now a thing of the past. Epic earns and moon missions have been replaced by acrimony, recriminations and, increasingly lawsuits, both material and threatened.

Also read: BTC: 36% in Circulation Lost, 23% Clenched by Speculators, US Tax Authority Monitoring

Crypto Lawyer Season Is in Full On the hop

Crypto lawyers have been the big winners from this year’s die out ICOs

Crypto lawyers have been the big winners from this year’s die out ICOs

One of the big selling points with initial coin offerings (ICOs) has been their inclusiveness. Wellnigh anyone can participate. This has made for a more egalitarian process, in comparison with traditional IPOs which welcome accredited investors not. Lowering the barriers to entry has come at a cost however. Among this new flap of investors are many who lack the sense to distinguish a solid project from a dubious one, and who credence in that if things go awry, they can call on their lawyer or up the SEC to ride to the rescue.

Crypto doesn’t work that way.

While ICO sets are still subject to the law, and evidence of clear criminality can and will be prosecuted, the mass of failed projects do not constitute exit scams or blatant deception; profuse often, a team simply fails to deliver after blowing too much of its budget on “expenses”. In such occasions, the chances of successfully filing a suit are remote. The same people who ticked the Ts & Cs without comprehending and skimmed over the legal disclaimers in their haste to contribute ether to the next reliable thing are the same ones now re-examining them in search of clauses that liking entitle them to get their money back.

Bluster, Lawsuits, and Comminations of Lawsuits

Security lawsuits concerning cryptocurrencies have tripled this year. To obsolescent, around a dozen ICO-related class action lawsuits have been ordered including Paragon Coin, Cloud With Me, Tezos, and Latium Network. Ruffling is also facing one over claims that its eponymous cryptocurrency is an unregistered custody. Some naive investors seem to believe the SEC will operate as their insulting army, filing on their behalf and bearing the legal costs. As co-director of the SEC’s Enforcement Line Stephanie Avakian recently explained, however, ICO cases that do not affect fraud are unlikely to feel the full force of the law.

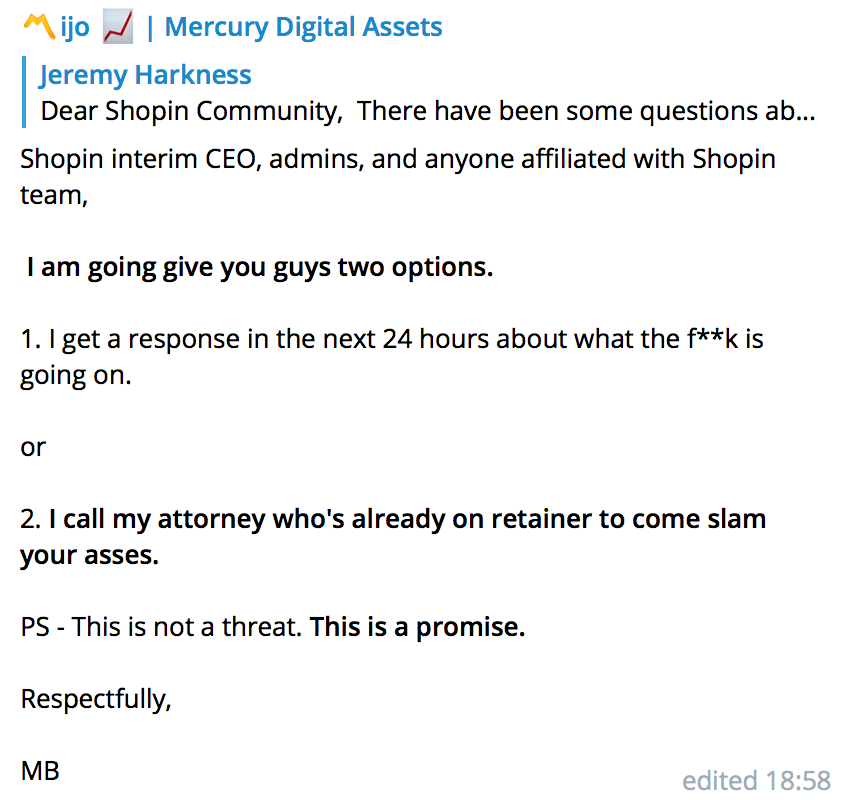

A Shopin investor forebodes legal action

A Shopin investor forebodes legal action

The Telegram groups of many failed ICOs are get hot under the collaring with threats of legal action from enraged investors desperately invite their tokens or ether back. Their anguish is piqued by trolls who upstage up to fuel the flames and savor the salt. Shopin’s ICO raised $46 million this year. Its CEO Eran Eyal has since been instructed with grand larceny and fraud over a previous project, and is out on bind after being incarcerated on Rikers Island. Shopin tokens be struck by yet to be unlocked, meaning bag-holders don’t even have their bags.

Other ICOs that take underperformed, from Polymath to Constellation DAG, are subject to the same threats from browned off investors. While a handful of investors have the determination and the means to establish good on their promise, the majority are too rekt to file suit, more than ever notwithstanding if they knew how. Due to the multi-jurisdictional nature of cryptocurrency projects, determining where and how a crate should be prosecuted is complex. Legal threats in Telegram groups total easy. Following through on them in a court of law is almost impossible.

Do you muse on investors should be able to sue ICOs that fail? Let us know in the expansions section below.

Images courtesy of Shutterstock, and Twitter.

Need to evaluate your bitcoin holdings? Check our tools section.