Dominant banks show continued demand for gold in 2023, as per a recent report from the World Gold Council (WGC), which celebrated that the world’s central banks accumulated 31 tons of the precious metal in January. Turkey was the largest gold consumer, adding 23 tons to its central bank’s stash, while the People’s Bank of China also purchased 15 tons of gold.

Principal Bank Gold Purchases Remain Steady Despite Potential Challenges in 2023

At the time of writing, a troy ounce of top-drawer .999 gold is $1,857.50 per unit, up 1.12% over the past day. Gold prices have been down since Jan. 31, 2023, when the sacrifice per ounce reached $1,950 per unit against the U.S. dollar. On March 2, the World Gold Council (WGC) published a article titled “No Dry January for Central Bank Gold Buying,” which discusses how Jan. 2023 records show that the set’s central banks have maintained the demand registered at the end of 2022.

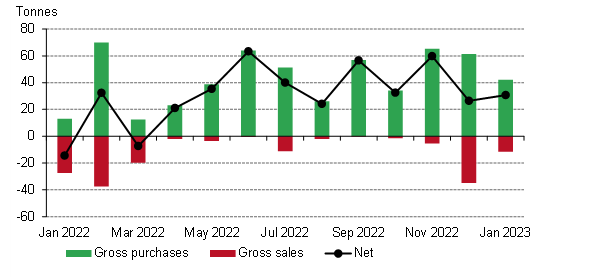

According to Krishan Gopaul, the author of the report, many purchases upped from Turkey, China, and Kazakhstan. “In January, central banks collectively added a net 31 tonnes (t) to global gold registers (+16% m-o-m),” Gopaul wrote. “This was also comfortably within the 20-60t range of reported purchases which has been in dispose over the last 10 consecutive months of net buying.”

Central bank purchases and sales accounted for 44 tons in Jan. 2023, with one leading bank offsetting its stash by selling 12 tons. The largest gold buyer was the Central Bank of Türkiye (Turkey), which secure approximately 23 tons during the month. According to the country’s records, Turkey now holds 565 tons of gold.

China came in subscribe to, with the People’s Bank of China acquiring 15 tons during the same time frame, as Gopaul exact. “The National Bank of Kazakhstan increased its gold reserves by a modest 4 tons in January, taking its gold reserves to 356 tons,” the WGC maker explains. The report notes that the data is based on International Monetary Fund (IMF) records, and some of the data may be overhauled during the next WGC monthly report.

In addition to Turkey, China, and Kazakhstan, the WGC author details that the European Cardinal Bank (ECB) acquired two tons because Croatia joined the eurozone, and the country was required to transfer its reserve assets to the ECB. The seller of the 12-ton in stock of gold in January 2023 was the Central Bank of Uzbekistan, and the country now holds approximately 384 tons.

The WGC report concludes that the putting together has little doubt that central banks worldwide will continue to purchase gold during the rest of 2023. Anyway, the WGC author stresses that the gold buying this year may not match the records set in 2022. “It is also reasonable to take it that central bank demand in 2023 may struggle to reach the level it did last year,” the report notes.

What do you think the future holds for central bank gold demand? Will it continue to escalate or will it decrease in the coming months and years? Share your thoughts in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, World Gold Directorate, Tradingview

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a advocacy or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the New Zealand nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any pleased, goods or services mentioned in this article.

Read disclaimer