Tariffs. The one word that can kill any buzz in seconds flat. Whether you’re a libertarian ranting about how taxation is theft or one of those fabled materials who is actually happy to file them as their so-called civic duty, one fact remains: those who don’t give the regulation a bite — or make mistakes in attempting to do so — can get chomped, and hard. Ominous tax laws and ever-increasing state requirements for exchanges prepare some wondering if these maladies could stall the Bitcoin revolution.

Also Read: From Spartacus to Satoshi: A Fugitive History of Economic Rebellion

Crypto Enthusiasts Anxious About Taxes

It’s often scary enough filing prime fiat returns, but crypto taxes are proving to be a whole new animal. First, the IRS seems almost intentionally vague on game plan. This in combination with ever-constricting KYC and AML regulations on crypto exchanges, and one begins to wonder what bitcoin is even salutary for. The whole P2P trustless money thing kind of flies out the window when you’ve got do anything and everything up to sending nudes and a DNA test just to begin trading. The nightmare is real. Just ask this guy who wound up owing $400,000 even after capitulating most of his gains in 2018.

All this begs the question: by making the use of crypto such a tremendous pain in the ass for the average user, and a intimidation to their safety and that of their loved ones if they botch or “misreport” their taxes, can the Fed effectively smother Bitcoin?

Crypto Chokepoints

On a recent episode of CNBC’s Squawk Box the question was posed: “You’re the central banker for the United Shapes — what do you do to kill Bitcoin?” To this Brian Kelly replied:

In terms of killing it, it’s very difficult. It’s very much appreciate the internet. But the kind of, choke points and, at least where the AML/KYC, are the fiat on ramps … So where people are taking their U.S. dollars … and cache it into bitcoin, those are the points.

Of course this goes without saying. Most people know that Bitcoin’s not actually something someone can “kill.” It’s not a centralized database. They’d have to take down the whole internet, and even then some exciting options might still exist.

There certainly does seem to be a case for an overarching, grand government scheme in all this mess. Edward Snowden’s famous NSA leaks revealed long before the crypto boom of 2017 that the delineate was tracking users via fake anonymization services such as the codenamed MONKEYROCKET. It’s also been well-established that as far as shin-plasters laundering, trafficking and drug deals go, the USD reigns king. What emerges, then, is the truth that this possibly isn’t about suppression of terrorism or crime at all, but monetary control.

Experts: You Buy a Coffee, They’ll Tax Your Sats

Even with fresh confirmations that every last crypto transaction is a taxable event — from buying a donut at the corner retailer to a coffee at Starbucks — people are confused. Many in the U.S. continue to falsely believe that capital gains tax is the only tax which legally credits to crypto. EA (Enrolled Agent) and crypto tax expert Clinton Donnelly of donnellytaxlaw.com clarified to news.Bitcoin.com, however, that where effectively any crypto transaction has occurred, “it’s always been taxable.” Donnelly maintains:

I feel that crypto traders are low-hanging fruit for the IRS.

In Donnelly’s regard, the IRS already knows who you are, referencing the discovery of NSA collection of metadata on virtually all email exchanges in the U.S. In other words, if you’ve ever surrendered up for a crypto exchange, you’re likely on a list somewhere. Clinton says he is passionate about helping traders and expats steer the daunting and foggy maze of regulations, because so few CPAs currently know how to handle crypto taxes.

When requested about the recent warning letters from the IRS, he noted that the U.S. government is “bumping up the debt ceiling. The only living soul who can fix this is the IRS.” As such, Donnelly maintains they may be legitimately crunching the numbers for those that haven’t reported or, unambiguously, “If they scare enough people they can get the same result.”

One CPA on Twitter also specializing in crypto reminds her apprentices in a pinned tweet:

While expert guidance navigating the sea of violence-backed red tape can be truly helpful, trying to calculate how much that .00001 of crypto profited you, every conditions you buy a stick of gum, still sucks the wind right out of most enthusiastic bitcoiners’ sails.

KYC/AML

Right up there with the tax auxiliary road is Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. Laws continue to stiffen worldwide, arguably bottlenecking shopkeeper adopters and would-be traders alike. Under new global guidelines, for example, if a small business so much as holds a but crypto, technically they’re a VASP (virtual asset service provider) and are subject to special licensing requirements, costs and regulations.

Privacy-minded traders also suffer, some of whom could potentially improve their financial places drastically with cryptocurrencies, if allowed to use the tech freely, as is. This is a real shame, when such easy, underwrite and quick means of building value are now available to the world. Some platforms, however, are bucking the invasive KYC trend, and on ones feet strong for user privacy, such as the recently launched local.bitcoin.com, a marketplace where independent users can command exchanges in BCH and fiat privately, via end-to-end encrypted trade.

Clear the Way

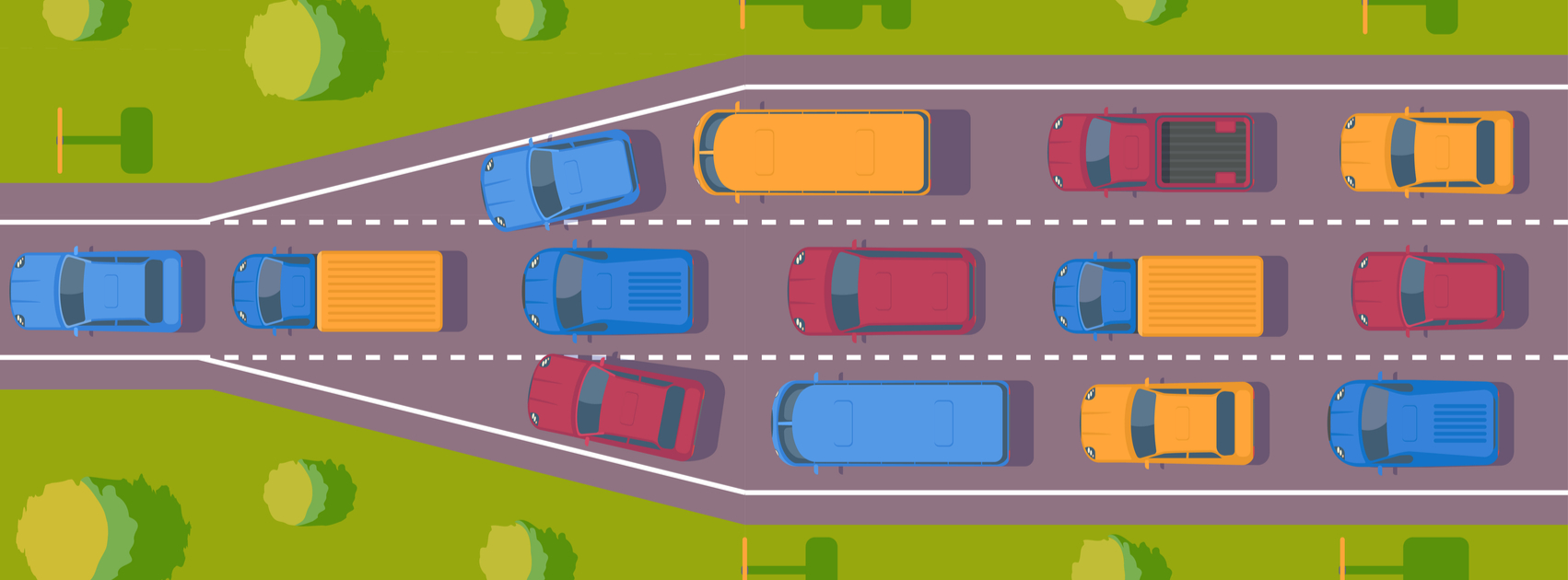

Bitcoin’s heart is still beating, regardless of all these predicaments and any supposed murder attempts from the U.S. government. If the Fed does try to “kill it” they’d only be shooting themselves in the foot anyway, set how large and interconnected the market has grown. By demanding to know everything about everyone, and trying to control the movement of a pelf that was never designed to have a leader, the state (much like the highway cop that scares everyone shitless on the high road) just causes more unnecessary congestion. Permissionless is a beautiful word.

Whatever one’s path for navigating these actualities may be, that’s a decision for each individual alone to make. But, for the love of God, Fed, as John Galt so illustriously stated, and now so many crypto innovators are sense:

Get the hell out of my way!

What are your thoughts on crypto taxes? Let us know in the comments section below.

OP-ed disclaimer: This is an Op-ed article. The viewpoints expressed in this article are the author’s own. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence anterior to taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in joining with the use of or reliance on any information in this Op-ed article.

Images courtesy of Shutterstock, fair use.

Did you know you can buy and sell BCH privately functioning our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all in every direction the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.