The analytics provider Ecoinometrics has leaked a tweetstorm that shows the current downward spiral from bitcoin’s all-time high is one of “the longest drawdowns bitcoin has had to apportion with during a post-halving bull market.” Furthermore, the same day, analyst and economist, Julio Moreno, highlighted in a current blog post that “in bitcoin, volatility is your friend.”

Analyst Discusses Bitcoin’s Second Longest Drawdown In the future the Next Price Move

Most people in the industry understand that bitcoin (BTC) prices have seen less ill days and many spectators are wondering when the crypto asset will rebound. The fact of the matter is, we really don’t be acquainted with, but people do leverage previous chart patterns from prior bull markets and have measured a number of timespans.

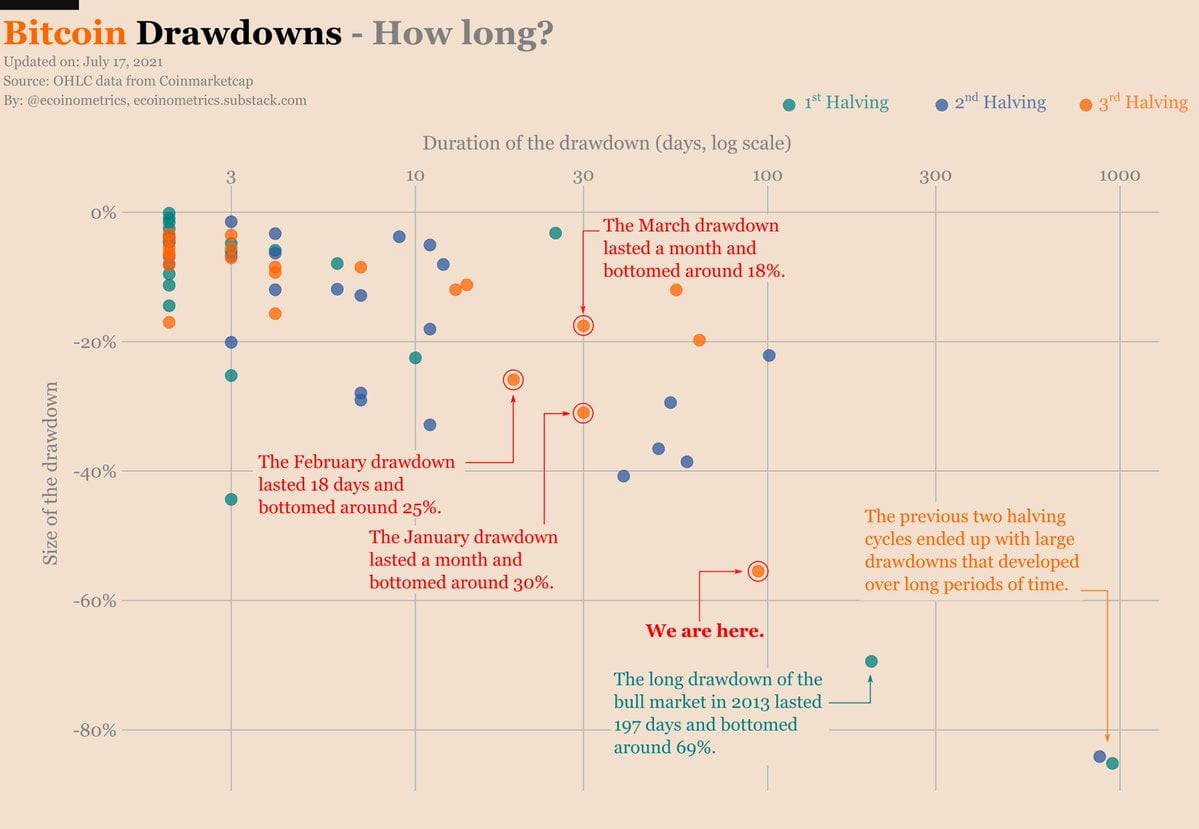

In brand-new times, Bitcoin.com News has published at least two market reports that show speculators believe this bull run resembles the liveliness that took place in 2013. According to the analytics provider Ecoinometrics, the current downturn is the second-longest drop since 2013 and there could be a lot more later left on the clock.

“Bitcoin after the Halving [on] Jul. 17, 2021,” Ecoinometrics tweeted. “431 lifetimes after the 3rd halving [and] BTC at $31,678. One more week stuck in this drawdown, 95 days since the last ATH, hindquarters -55% below the ATH, and volatility continues to decline,” the analyst added. Ecoinometrics further stressed:

This is one of the longest drawdowns bitcoin has had to engage in with during a post-halving bull market. But 95 days is still only half the duration of the big drawdown of 2013… In with regard ti of price trajectory, this correction also looks very similar to 2013. If we continue like that, BTC desire remain stuck around $30k for a while.

The analyst also added that bitcoin’s one-month volatility was also down but “historically talk to, it isn’t particularly low.”

“So from that perspective it is possible for the trading range to stay pretty tight for longer,” Ecoinometrics concluded.

Analyst and economist Julio Moreno agreed with Ecoinometrics’ volatility assessment, and pieced a recent blog post he wrote about bitcoin volatility. Moreno’s report explains how people try to discredit bitcoin atop of price volatility, and his study asks whether or not “volatility [is] a bad thing.”

The analyst notes in his report that he doesn’t take it volatility is necessarily a bad thing. “I would say it is not, as it increases within each cycle along with price gains. When is bitcoin’s outlay more volatile? Mostly at market tops, after significant price appreciation,” Moreno’s report emphasized. His bitcoin volatility publish concludes:

What does changes in bitcoin’s price volatility imply about its future trend? Accumulation has been happier at low levels of volatility and this is typically reached before a big price movement.

What do you think about the assessments from Ecoinometrics and Julio Moreno’s inquire inti? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Ecoinometrics

Disclaimer: This article is for informational results only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not contribute investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss occasioned or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer