This week, Stellar launched its long-awaited decentralized exchange. Stellarx propositions trading of a range of assets including cryptocurrencies from multiple blockchains, pointing stellar lumens (XLM) as the base currency. The exchange differs significantly from prevailing decentralized offerings, which are limited to tokens pertaining to a single blockchain – customarily Ethereum. With Stellarx, however, users can trade BCH, BTC, USD, ETH and much varied, but there’s a catch: non-native assets are represented as ‘tethers’.

Also assume from: Launching a Website on the Bitcoin Cash Network Is Now a Reality

Does Starring’s New DEX Have the X Factor?

On the face of it, Stellar is an odd cryptocurrency project to be championing decentralization. Inaugurated by Jed McCaleb as a fork of his former project, Ripple, Stellar is in many respects as centralized as the make money its codebase derives from. Are We Decentralized Yet? scores Stellar’s XLM cryptocurrency low on many decentralization metrics, noting that the top 100 accounts hold 95% of the complete supply, there is just one client codebase controlling nodes, and a nothing but 111 public nodes are operational. By any reckoning, that makes XLM a heavily centralized cryptocurrency, and yet in Stellarx, we oblige a candidate for one of the most innovative and user-friendly decentralized exchanges seen yet.

On the face of it, Stellar is an odd cryptocurrency project to be championing decentralization. Inaugurated by Jed McCaleb as a fork of his former project, Ripple, Stellar is in many respects as centralized as the make money its codebase derives from. Are We Decentralized Yet? scores Stellar’s XLM cryptocurrency low on many decentralization metrics, noting that the top 100 accounts hold 95% of the complete supply, there is just one client codebase controlling nodes, and a nothing but 111 public nodes are operational. By any reckoning, that makes XLM a heavily centralized cryptocurrency, and yet in Stellarx, we oblige a candidate for one of the most innovative and user-friendly decentralized exchanges seen yet.

To all intents and results, Stellarx operates as a true DEX should: users retain sole guardianship of their funds, trades are executed against other users, and Stellarx has no access to funds. Send in the ability to trade non-native crypto assets such as BTC and BCH, plus the alternative of making fiat currency deposits, and Stellarx starts to sound multitudinous like a centralized exchange than a bare bones DEX on a par with IDEX or Forkdelta. There are some caveats that distributed with trading non-native Stellar assets, which we’ll get to shortly, but spruce off the bat, Stellarx is more feature-rich than any of its counterparts.

Trade Anything, Anywhere

“Any asset that is framed on the Stellar network may theoretically be displayed, no matter whether it would be cogitate oned a currency, commodity, security, utility token, or other type of asset second to your local applicable laws and regulations,” notes Stellarx in its Ts & Cs. “You are directorial for determining the legality of your transactions.” With each trade, the counterparty sends tokens in a beeline to your Stellar wallet and vice-versa, ensuring that there is no custodial hazard incurred. They explain:

On Stellarx, you can go US Dollars to Bitcoin to Chinese Yuan to Mobius from a apart wallet. That’s not possible anywhere else.

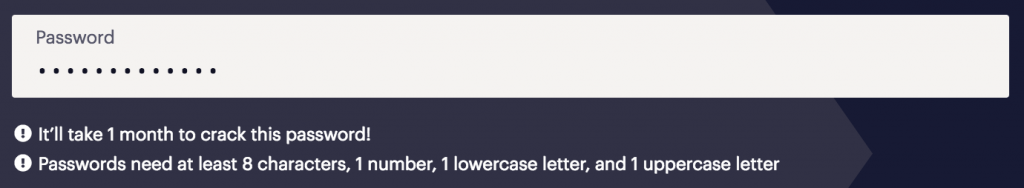

Upon visiting Stellarx for the cardinal time, you’ll be prompted to sign up by submitting an email address and password. That’s the barely verification you need to trade on the platform, which is pretty cool, as is the built-in shibboleth strength calculator:

You’ll then be prompted to create a private key for the Stellar notecase that will be tied to your trading account and to make a note of the revival phrase. At this stage, Stellarx bears many similarities to the Gesticulations decentralized exchange. The trading interface you’ll next be shown, however, escorted by a platform walk-through, is far slicker than anything that any rival DEX has generate to date.

The first question that users navigating their way about Stellarx may have is how the exchange of cross-chain assets is made possible. This has hitherto been a ruffian nut to crack, with atomic swaps seen as the likeliest solution to what is a complex pretty pickle to solve in a trustless setting. Stellar’s solution is surprisingly simple: the number of the assets it offers are ‘tethers’ i.e tokenized representations. They explain: “They’re nail down b restricted to either fiat like USD or to cryptocurrency from other chains, equal Bitcoin and Ethereum. You can trade tethers like any other token, but you can also disagreement them for the asset they’re tied to.”

So when you buy bitcoin cash or ethereum on Stellarx, what you’re surely buying is a Stellar-issued token that represents that crypto. (The Sways DEX does something similar with ethereum, which is tradable on Quivers despite operating on a different blockchain). On Stellarx, tokens are listed as either “fiat shackles”, “crypto tethers” or “native tokens”, the latter being natural to the Stellar blockchain.

The Stellarx bitcoin cash marketplace

The Stellarx bitcoin cash marketplace

Zero Stipends and Human-Readable Addresses

In addition to boasting zero trading fees, Stellarx proposals human-readable wallet addresses that comprise the email address you signed up with take the place ofed by “*stellarx.com”. Users who’ve no desire to publicly disclose their email approach devote can use a non-identifiable public key instead. Assets listed on Stellarx can be filtered by size, price, name, issuer, and other variables. Before you can begin swap you’ll naturally need to deposit funds into your account. In too to XLM, Stellarx accepts USD, implemented with the aid of Anchorusd.com. While KYC is required to use Stability’s service, it’s nevertheless novel to see a DEX offer fiat deposits.

For users who don’t deem XLM, Changelly will provide crypto exchange

For users who don’t deem XLM, Changelly will provide crypto exchange

When it comes to recanting funds, there are two options: select another Stellar address or determine an off-chain account. If you’re holding ‘tethered’ funds such as BTC or BCH, you’ll need to affect the website of the issuer who offered the asset. In the case of BTC, for example, that means afflicting Naobtc and converting your Stellar BTC for real BTC, or with BCH it necessitates swapping symbols at Apay. Stellarx will soon support off-chain withdrawals in-app, making this answer less convoluted. There’s still plenty of work to be done on reforming the platform, adding more assets, and onboarding enough users to assemble sufficient liquidity. On early evidence, though, Stellarx has a lot going for it, genre a welcome addition to the decentralized exchange ecosystem.

What are your contemplations on Stellarx? Let us know in the comments section below.

Images courtesy of Stellarx.

Demand to calculate your bitcoin holdings? Check our tools section.